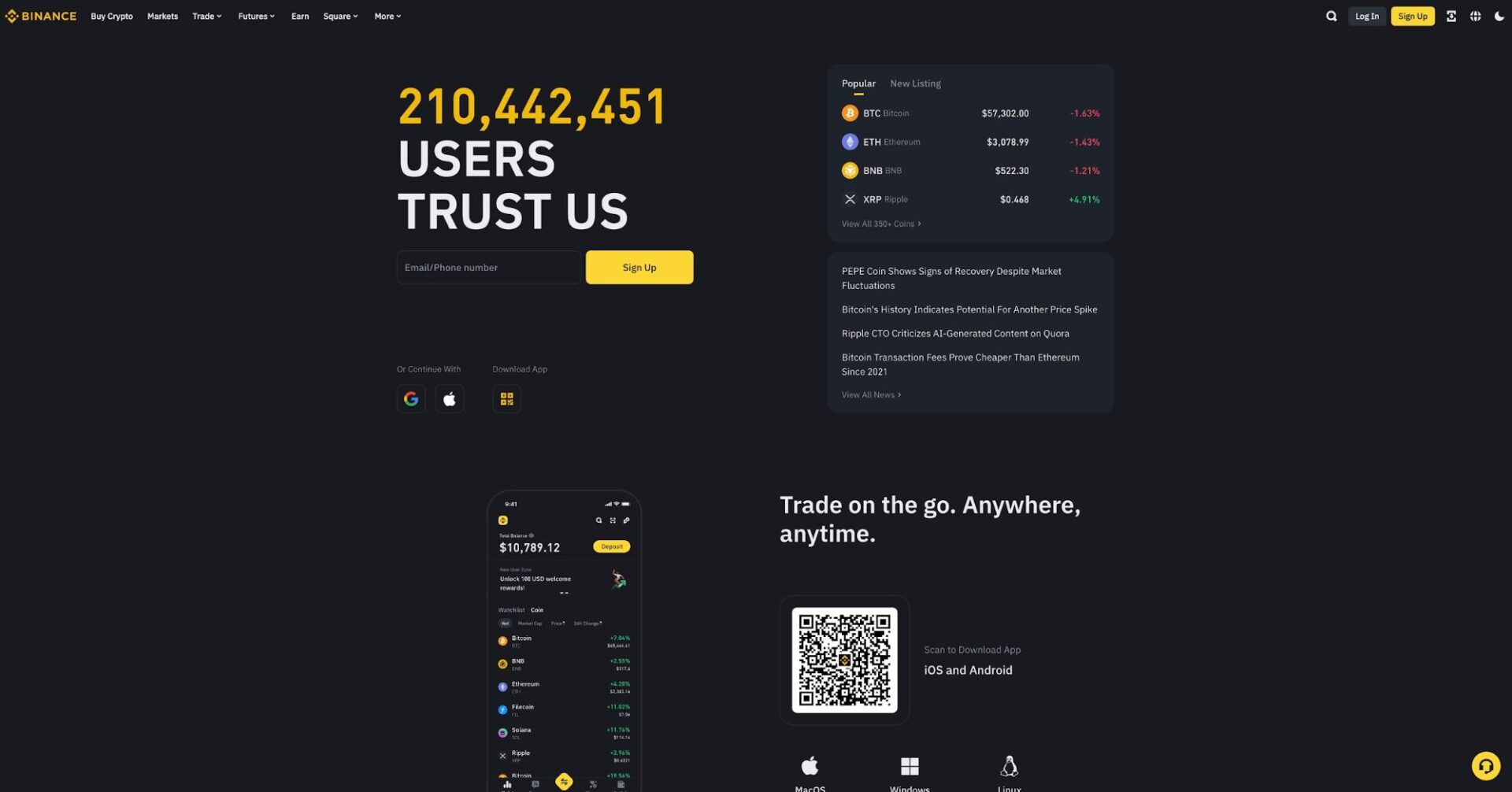

The best zero fee crypto exchanges to buy Bitcoin and crypto are Binance, MEXC, Bybit, Coinbase, Kraken, KuCoin, Bitfinex, and Bitstamp. Since all zero-trading-fee crypto exchanges offer different products and services in addition to low fees, choosing which one best suits your needs can be challenging.

Therefore, we reviewed various free crypto trading platforms using factors like security, supported cryptocurrencies, ease of use, and liquidity to determine the best ones. In addition to the compiled list, this article also dives deep into the types of fees that apply on crypto exchanges, including trading fees (maker & taker fees), deposit fees, withdrawal fees, and margin/futures fees.

In addition, we will answer essential questions, like how can I minimize exchange fees? What are the criteria to evaluate when choosing the best no-fee exchange? And how to buy Bitcoin & crypto without fees?

But before we proceed, the table below provides a detailed comparison of the best zero fee crypto exchanges for buying Bitcoin and crypto in 2025.

Our Rating Zero Fee Feature Supported Crypto Additional Features Binance 9.7 Cheapest crypto exchange for fiat to crypto transactions 500+ Binance Launchpad, Binance Earn, and Binance Web3 Wallet. MEXC 9.5 Zero fees for special trading pairs 2700+ MEXC Launchpool and Kickstarter, and MEXC referral program Bybit 9.5 Zero fee trading for market makers and takers 650+ Copy trading tools, Bybit card, and trading bots. Coinbase 9.1 No fees for Coinbase One subscribers 250+ Coinbase card, Coinbase Pro, and Coinbase Wallet. Kraken 8.8 Zero fee trading for high volume traders. 200+ Crypto staking, Kraken Pro, and educational resources. KuCoin 8.6 Best for negative fee rates (-0.015%) 700+ Automated trading tools, earning opportunities, and fast trade. Bitfinex 8.4 Zero maker fees for newly listed altcoins 170+ Margin funding, OTC Desk, and paper trading Bitstamp 8.2 Lowest zero fee crypto exchange 100+ Lending and borrowing, Bitstamp institutional solutions, and basic/advanced interfaces. 1. BinanceBinance is a top crypto exchange that allows users to buy trade spot pairs, futures contracts, options, and margin contracts, and buy Bitcoin and crypto at low fees. For trading fees, Binance operates a tiered fee structure, charging different fees from regular users to VIP 9 users. Here is the transaction fee structure for various trading options on Binance:

Spot Trading Fees

Regular users pay 0.1% for makers and takers. You can get a 25% discount and pay 0.75% if you use BNB (Binance native token). VIP 9: 0.0110% maker fees and 0.0230% for takers.Futures Trading Fees

Regular Users: 0.020% and 0.050% maker fees and taker fees. VIP 9 Users: 0.0000% maker fees and 0.0170% for takers.Margin Trading Fees

Regular users: 0.1% for maker and taker fees. 0.75% with BNB. VIP 9: 0.0110% maker fees and 0.0230% for takers.Options Trading Fees

0.0300% maker fees and 0.0300% for takers on all traders.Deposit Fees: Zero Fees

Withdrawal Fees

Binance withdrawal fees vary depending on whether you are depositing crypto or fiat currencies. If you are depositing funds, withdrawal fees will depend on the blockchain network and network congestion.

Binance Security

Binance uses various security measures, such as two-factor authentication, address whitelisting, and SSL encryption, to protect users’ funds and data. They also use MPC (Multi-Party Computation) technology to secure the Web3 Wallet.

Binance pros

500+ supported digital assets and 1300+ supported pairs Multiple trading options and order types The exchange has robust security measures and a stringent KYC policy. Binance supports fiat-crypto transactionsBinance cons

Regulatory challenges in many countries Customer support could be better Only available in the US through Binance.US.Join Binance today to enjoy exclusive perks and claim up to $100 in new user bonuses!

User Score

10

Exclusive Benefits

$100 Trading Fee Rebate

Permanent 10% Reduced Trading Fee

OPEN ACCOUNT NOW 2. MEXCMEXC is a leading crypto exchange popular for its high performance, multiple cryptocurrency support, user-friendly interface, and incredibly low fees. MEXC charges the lowest fees for spot, margin, and futures markets. Here’s a breakdown of transaction costs for various trading activities on the MEXC Exchange;

Spot Trading Fees

MEXC’s spot trading fees are 0.050% for both makers and takers. You can get a 20% discount on trading fees if you use the MX token to pay fees.

Futures Trading Fees

MEXC charges 0.010% for market makers and 0.040% for takers fees. They also charge 0% for makers and takers on special trading pairs. For discounts, you can either hold MX position above 500 over the last 24 hours for a 50% discount on futures trading costs or transfer MX into your futures account and get 20% off.

Deposit Fees: Zero Fees

Withdrawal Fees:

MEXC does not charge withdrawal fees for some cryptocurrencies, like Tether USDT. However, it does for others, and these fees depend on the Blockchain network and network congestion at the time of the transaction.

As a new user, you can register with this MEXC referral code and receive trading fee discounts and up to $10,000 in sign-up bonuses!

MEXC Security

MEXC secures user funds using robust security features, such as two-factor authentication, cold wallet storage (over $500 million in cold storage), multi-sig authorizations, address whitelisting, and regular security audits.

MEXC Pros

Supports over 2,700 cryptocurrencies and more than 3,000 trading pairs. The registration process on MEXC is straightforward and can be completed in under a minute. Users can start trading immediately without mandatory KYC verification.MEXC Cons

Some users report issues with locked funds and account bans. Withdrawals in fiat currencies are restricted. Not available in the US.Sign up on MEXC today to enjoy a 10% discount on trading fees and claim exclusive bonus rewards of up to $1,000!

User Score

9.5

Exclusive Benefits

$1,000 bonus

10% reduced trading fee

OPEN ACCOUNT NOW! 3. BybitBybit is a leading zero fee exchange that offers traders various services for cryptocurrency trading in one place. On Bybit, Users can trade crypto in the spot, margin, futures, and options markets and explore various decentralized applications and Web3 projects through the in-app Web3 Wallet.

Bybit has a tiered fee structure for cryptocurrency trading services. Here’s a rundown of the fee structure on Bybit.

Spot Trading Fees

Non-VIP Users: 0.1% for makers and takers. Supreme VIP: 0.03% and 0.045% for makers and takers, respectively. Pro 6: 0.005% for makers and 0.015% for takers.Perpetuals and Futures Trading Fees

Non-VIP Users: 0.02% for makers and 0.055% for takers. Supreme VIP: 0.000% for makers and 0.030% for takers. Pro 6: 0.000% for makers and 0.0280% for takers.Options Trading Fees

Non-VIP Users: 0.02% for makers and 0.03% for takers. Supreme VIP: 0.005% for makers and 0.015% for takers. Pro 6: 0.000% for makers and 0.010% for takers.Deposit Fees: Zero Fees

Withdrawal Fees

Withdrawal fees on Bybit vary depending on the Blockchain network and network congestion. You can always check the withdrawal fees in real time to determine how much you need to pay.

Bybit Security

Bybit employs security features like withdrawal whitelists, 2FA, anti-phishing code, fund password, and multi-signature (multi-sig) technology to ensure the safety of users’ accounts.

Bybit Pros

Demo trading allows users to practice trades without risking their own money. Robust security measures Automated trading tools, including TradeGPT, trading bots, and copy trading.Bybit Cons

Direct fiat deposits or withdrawals are unavailable in some fiat currencies. Not available in the US.Join Bybit today to access exclusive trading benefits and claim up to $30,000 in new user bonuses!

User Score

9.5

Exclusive Benefits

$30,000 Blast Bonus

Welcome Bonus $20 & 30% Trading Fee Rebate

OPEN ACCOUNT NOW 4. CoinbaseCoinbase is the largest cryptocurrency exchange in the United States by trading volume. The low fees of the crypto exchange facilitate the buying, selling, converting, and storing of various cryptocurrencies, making it accessible to novice and experienced traders.

When it comes to trading fees, Coinbase Exchange also uses a maker-and-taker fees model to calculate trading costs. Here are details of the various transaction fees on Coinbase Exchange.

Spot Trading Fees

Coinbase charges 0.4% for makers and 0.6% for takers. You can get discounts on trading fees up to 0.000% makers and 0.050% takers with a higher 30-day trading volume.

Deposit Trading Fees

Direct crypto deposits on Coinbase are free. For fiat deposits, fees start at;

ACH: Free Wire (USD): $10 USD SEPA (EUR): 0.15 EUR Swift (GBP): FreeWithdrawal Trading Fees

ACH: Free Wire (USD): $25 USD SEPA (EUR): Free Swift (GBP): £1 GBPTraders who prefer zero fee trading on Coinbase can use Coinbase One. It is a subscription product allowing users to trade for $29.99 a month without attracting fees.

Coinbase Security

Coinbase uses advanced security features, such as two-factor authentication, cold storage for 98% of user assets, biometric verification, data encryption (AES-256 encryption and TLS), and insurance for hot wallets and digital assets against theft.

Coinbase Pros

Simple, clean, and user friendly interface. Coinbase offers resources that allow users to earn cryptocurrency while learning. Quick crypto withdrawals Available in the US.Coinbase Cons

Relatively high fees compared to other exchanges on this list. Users do not have access to private keys on Coinbase Exchange. 5. KrakenKraken is one of the best alternative exchanges to Coinbase for crypto traders who need a reliable exchange in the United States. The exchange offers a platform for users to do more than buy, sell, and swap cryptocurrency assets.

The Kraken fee structure differs between the standard Kraken platform and Kraken Pro. Here’s how the fees are charged;

Standard Kraken Trading Fees

Instant Buy/Sell Fees: The fee for instant buy and sell can be around 3.75% + €0.25 and 0.5% for bank transfers. Convert Small Balances: Kraken has a 3% fee for converting small balances below the minimum order size.Kraken Pro Trading Fees

Kraken Pro uses a maker and taker fees model, and the trading fees decrease as your trading volume increases.

30-day Trading Volume Under $10,000: Maker fee is 0.25%, and the taker fee is 0.40%. 30-day volume over $10 million: Fees are as low as 0.00% for makers and 0.10% for takers.Deposit Fees

Direct crypto and fiat currency deposits are free on Kraken.

Withdrawal Fees

For fiat withdrawals, fees range from $0 to $35, depending on the currency and payment method used. For crypto withdrawals, transaction costs depend on the cryptocurrency and network conditions.

Kraken Security

2FA, email confirmation, withdrawal confirmations, customizable API keys, PGP encrypted emails, real-time platform monitoring, account timeout, session monitoring, global time lock, and SSL encryption.

Kraken Pros

Kraken Pro offers advanced trading options and tools for experienced traders. Educational resources to help new users familiarize themselves with the exchange. Available in some US states.Kraken Cons

Payment options are limited. Customer support could be better. Only accepts a few fiat currencies. 6. KuCoinKuCoin is a top zero-fee crypto exchange popularly known as the “people’s exchange” due to its extensive service offering, user-friendliness, and low trading fees. KuCoin supports over 700 cryptocurrencies and 1,300+ trading pairs, making it the ideal exchange for users who want to buy Bitcoin and crypto without incurring high fees. Here’s an overview of KuCoin Exchange fees.

Spot Trading Fees

Level 0: 0.10% for makers and takers. Users can get a 20% discount when they pay using KuCoin Token (KCS). VIP Levels: Traders with a higher 30-day trading volume enjoy further fee cuts. For instance, Lv 12 users pay -0.005% and 0.025% makers and takers fees.Futures Trading Fees

KCS discounts do not apply to futures contracts.

Level 0: Lv 0 users pay the regular trading fees (0.020% and 0.060% makers and takers). VIP Levels: Lv 1 users pay 0.018% for makers and 0.060% for takers. Meanwhile, Lv 12 futures traders pay -0.008% and 0.025% makers and takers fees.Note: You can get an additional 10% rebate and earn up to 10,800 USDT in sign up bonuses when you use the current KuCoin referral code to open a new account.

Deposit Fees

Zero fees for direct crypto deposits and most fiat currencies. However, KuCoin charges a fee for EUR deposits, usually around EUR 1, depending on the withdrawal amount.

Withdrawal Fees

Withdrawal fees for crypto vary, depending on the token and the Blockchain network.

KuCoin Security

KuCoin employs bank-grade security measures and other robust features to protect user funds. The security systems include 2FA, real reserves backing user assets, and a risk control system (account verification and risk identification).

KuCoin Pros

The demo trading and copy trading options make it easy for newbie traders to adjust quickly. KuCoin has advanced trading features that support all traders’ needs and trading strategies. Users can stake and lend their crypto to other traders in exchange for profits.KuCoin Cons

Some altcoins may have low trading volumes, slowing down trade execution. Not available in the US 7. BitfinexBitFinex is a low-cost crypto exchange that offers traders the option of exchange trading, margin trading, over-the-counter markets, and derivatives trading. The platform also provides a customizable interface feature that allows you to personalize your workstation.

While Bitfinex might be complicated for new beginners due to extensive product offerings and features, the platform offers incredibly low fees, making it an attractive choice for traders. Bitfinex fees are;

Spot Trading Fees

0.100% maker fees and 0.200% taker fees.

Derivatives Trading Fees

0.0200% maker fees and 0.0650% taker fees. Bitfinex offers discounts to UNUS SED LEO (native token) holders, 0.0200% for market makers and 0.0650% for takers.

Deposit Fees

Crypto deposits are free on Bitfinex. However, deposits via bank transfer cost 0.1% (minimum fee of $20).

Withdrawal Fees

Bitfinex withdrawal fees also depend on the crypto and the blockchain networks. For instance, the average fee for Bitcoin withdrawal is capped at 0.0004 BTC and 0.01 XRP for Ripple. So, always check the current fees charged at the point of withdrawal.

Bitfinex Security

Bitfinex ensures the safety of users’ funds by requiring a second verification form for sensitive operations like withdrawals. They also store substantial funds offline, in multi-signature cold wallets, and conduct regular audits to improve security protocols.

Bitfinex Pros

Paper trading (Demo account) for new users to practice trading. Responsive customer support through email. The Bitfinex mobile interface is more user friendly than the web version.Bitfinex Cons

No insurance or Proof of Reserves for customer funds Not available in the United States 8. BitstampBitstamp is a cryptocurrency exchange that offers tools for individual trading and fiat to crypto services for institutions like family offices and hedge funds. Bitstamp offers low/zero trading fees ranging between 0% – 0.04%, making it an ideal choice for traders who are more interested in trading Bitcoin and other known altcoins.

Fee Schedule

< $10,000: 0.30% for makers and 0.40% for takers. > $10,000: 0.20% makers and 0.30% takers fees. > $100,000,000: 0.00% for market makers and 0.06% for takers. > $1,000,000,000: 0.00% makers and 0.03% takers fees.Staking Fees

ETH – 15.00% ALGO – 15.00% ADA – 25.00%Deposit Fees

All cryptocurrency deposits on Bitstamp are free.

Withdrawal Fees

The exact crypto withdrawal fee on Bitstamp is usually disclosed before you confirm the cryptocurrency withdrawal due to network instability.

Bitstamp Security

Bitstamp has insurance, uses institutional grade custody solutions from custodian BitGo, and places 98% of user assets in cold storage. Additionally, Bitstamp encourages withdrawal address whitelisting and uses Multi-sig technology to safeguard their hot wallets.

Bitstamp Pros

Crypto staking, allowing users to earn interest by staking their crypto assets. 24/7 customer support Cold wallet storage to protect funds from hackers.Bitstamp Cons

The verification process could be better Staking and lending services are not available to traders in the US, the UK, Canada, and Singapore. What Types of Fees Apply on Crypto Exchanges?The types of fees that apply on cryptocurrency exchanges are trading fees (maker and taker fees), deposit fees, withdrawal fees, and margin/futures fees. For a better understanding, here is a breakdown of how these exchanges charge these fees.

Trading Fees (Maker & Taker Fees)Trading fees are charges cryptocurrency exchanges take when traders execute buy or sell orders. Most exchanges charge based on the maker and taker fees model to compensate for the services they offer traders, including trade execution, liquidity, and market access.

What’s the Difference Between Maker and Taker Fees?The difference between maker and taker fees is that market makers place limit orders (orders filled at a future price that the trader sets). This order adds liquidity to the market since it creates opportunities for others to trade. For this reason, they pay lesser fees than takers.

On the flip side, takers place market orders that are filled immediately, therefore removing liquidity from the market. This results in higher fees (taker fees) due to the immediacy of their transactions.

Deposit FeesDeposit fees are charged when traders deposit crypto or fiat to their trading accounts. Exchanges do not charge traders for direct crypto deposits, but users might incur additional fees when depositing fiat currencies.

Withdrawal FeesWithdrawal fees on crypto exchanges are charges traders incur when transferring cryptocurrency from one exchange to an external wallet. These fees vary significantly depending on the exchange, the type of cryptocurrency you are withdrawing, the Blockchain network, and network conditions.

Margin/Futures FeesMargin fees are charges traders pay when they open positions with borrowed funds from a crypto exchange. Meanwhile, futures fees are transaction costs associated with contracts that allow traders to speculate on price movements without owning the underlying asset.

What are the Criteria to Evaluate When Choosing the Best No-Fee Exchange?The factors to consider while deciding the best no-fee crypto exchanges are features, security, supported cryptocurrencies, ease of use, and liquidity.

Security

Look for crypto exchanges that undergo regular security audits, use cold storage for assets, withdrawal whitelisting, two factor authentication, and other robust security protocols to safeguard user funds.

Supported Cryptocurrencies

Ensure the crypto exchange supports a wide range of cryptocurrencies and trading pairs that you wish to trade. Some exchanges have only a few hundred coins, while others have a few thousand; choose one that does not restrict your trading options.

Ease Of Use

The exchange you opt for should be easy to navigate, with quick registration, accessible trading tools, educational resources, reliable customer support, and demo accounts for you to practice.

For instance, MEXC has the fastest registration process, requiring only your email and a MEXC referral code. Always do your own research and compare features, network fees, and security to determine which zero-fee exchange is best for you.

Liquidity

The crypto market is highly volatile. You want an exchange that fulfills orders at the price you choose without significant slippage. So, Check the exchange’s daily trading volume and the liquidity of the pairs you intend to use.

How To Buy Bitcoin & Crypto Without Fees?To buy Bitcoin and crypto without fees, use any of our best zero fee crypto exchanges. Most of these platforms, like MEXC and KuCoin, charge zero fees, while others charge as low as 0.10% for regular users.

Binance and MEXC are good exchanges to buy Bitcoin and crypto; they provide 0% fees for spot and futures trading. If you want to compare or learn more about the two exchanges, read this comprehensive Binance review and MEXC review.

How can I Minimize Exchange Fees?To minimize exchange fees, you can do any of the following:

Choose a crypto trading platform with the lowest fees. If the exchange has a native token, use it to pay for network fees and get up to a 20% discount. Increase your 30-day trading volume to qualify for lower fee tiers (if your exchange uses a tiered fee structure). Use a promo code, like this Binance referral code, to open a new account. These codes offer fee discounts, trading fee rebates, and free welcome rewards to new users. Check out this crypto sign up bonus article for referral codes of other exchanges to reduce additional trading fees by 10-30%.The post Best Zero Fee Crypto Exchanges to Buy Bitcoin & Crypto in 2025 appeared first on CryptoNinjas.