Spearheaded by Senator Cynthia Lummis (R-WY), the proposal has ignited debates over the role of cryptocurrency in national finance and monetary policy.

In a recent interview with Yahoo Finance, Senator Lummis outlined her ambitious plan to establish a U.S. Bitcoin reserve. The proposal involves the federal government purchasing 200,000 bitcoins annually for five years, amassing a total of one million bitcoins to be held for at least two decades. Lummis emphasized that this reserve could bolster the U.S. dollar and help mitigate the nation’s mounting debt.

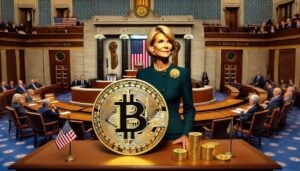

Senator Cynthia Lummis discusses her vision for a U.S. Bitcoin reserve. Source: Yahoo Finance

“Bitcoin is the ideal strategic asset,” Lummis stated. “It’s finite, akin to digital gold, and has proven to grow in value over time despite short-term volatility.”

Federal Reserve’s Stance and Legal HurdlesHowever, pointing to legal restrictions, Federal Reserve Chair Jerome Powell resisted the idea of a Bitcoin reserve. Powell stated at a press conference, “We’re not seeking a law change to accommodate this, and we’re not allowed to own Bitcoin under the Federal Reserve Act.”

Despite the Federal Reserve’s skepticism, supporters argue that a Bitcoin reserve might provide long-term economic benefits. According to Bitwise Asset Management CIO Matt Hougan, a strategic reserve may significantly raise the value of Bitcoin, with a long-term growth potential of $500,000 per Bitcoin.

Trump Administration’s Crypto AmbitionsThe project supports President-elect Donald Trump’s pro-crypto position. Trump has indicated strong support for establishing a strategic Bitcoin reserve, describing it as a move to ensure US dominance in the digital asset industry. His administration’s plans also include appointing David Sacks as the nation’s “AI and Crypto Czar” and Paul Atkins as Chair of the Securities and Exchange Commission (SEC).

Trump’s vision extends beyond Bitcoin, with plans to integrate AI and blockchain innovations into broader economic strategies. “We don’t want China or others to take the lead in crypto,” Trump said in a recent interview.

Criticism and Global PerspectiveThe proposal has not been without criticism. Former Federal Reserve Bank of New York President Bill Dudley labeled the plan a “bad deal” for Americans, highlighting Bitcoin’s notorious volatility and speculative nature.

Globally, skepticism also looms. European central bankers, including ECB policymaker Olli Rehn, dismissed the notion of Bitcoin as a viable reserve asset. “Cryptos are assets, but they are not currency,” Rehn asserted.

Experts note that funding the proposed Bitcoin reserve could be complex. Barclays analysts suggest that such a program would require Congressional approval, the issuance of new Treasury debt, and potentially reallocating assets from existing reserves, such as gold.

What Lies AheadBitcoin price chart. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

As Congress debates the bill, the crypto market continues to respond. Bitcoin’s price, which recently exceeded $100,000, dipped following Powell’s remarks but remains a focal point for investors betting on its adoption by nation-states.

While the idea of a Bitcoin reserve symbolizes a bold shift in U.S. financial strategy, its feasibility and potential benefits remain hotly contested. Whether this proposal becomes a reality or remains an ambitious concept will depend on navigating legislative hurdles, economic implications, and global skepticism.