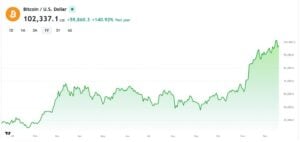

Hut 8, a prominent player in North America's Bitcoin mining sector, has boosted its Bitcoin reserves amid the current crypto bull market. A $100 million Bitcoin purchase has pushed the company's reserve to 10,096 coins, valued at over $1 billion as of today (Thursday).

According to the official statement by the company, Hut 8 acquired approximately 990 Bitcoin at an average price of $101,710 each, complementing its previous holdings.

A Billion-Dollar Bitcoin Reserve

The company's reserve was built through a mix of low-cost production and timely market purchases, achieving an average acquisition cost of $24,484 per Bitcoin. This substantial reserve allows Hut 8 to leverage its holdings in multiple ways, including financing large-scale projects and optimizing its balance sheet.

He emphasized that as Bitcoin production scales, Hut 8 expects to expand its holdings at a lower-than-market cost, further strengthening its reserve strategy.

Commenting about the acquisition, Asher Genoot, the CEO of Hut 8, said: "A key component of our treasury strategy, the strategic Bitcoin reserve supports a flywheel effect that aligns our capital and operating strategies to accelerate value creation across the business."

"We believe deeply in our operating business and that building a strategic Bitcoin reserve will fortify our financial position as we pursue large-scale growth initiatives across power and digital infrastructure."

🟢Publicly traded @Hut8Corp to raise up to $500 million and buy #Bitcoin $BTC as a strategic reserve asset. pic.twitter.com/RPoETu2lyy

— Blockviews (@blockviews) December 4, 2024The company's Bitcoin reserve will support key growth initiatives, including upgrading mining fleets and developing energy and digital infrastructure. Hut 8's CFO, Sean Glennan, highlighted the reserve's role in driving returns for shareholders through strategic treasury management.

In tandem with its Bitcoin-centric strategy, Hut 8 has announced two new programs: a $500 million at-the-market (ATM) equity offering and a $250 million stock repurchase plan. Proceeds from the ATM program will fund growth initiatives like energy asset acquisitions and infrastructure development.

Stock Repurchase Plan

The stock repurchase plan allows Hut 8 to buy back up to 4.68 million shares, potentially boosting shareholder value. These programs, alongside a recent SEC filing to ensure compliance, underscore Hut 8's commitment to navigating market volatility while maintaining a strong financial position.

Hut 8's $1 billion Bitcoin reserve highlights the growing role of cryptocurrencies in corporate finance. By treating Bitcoin as a versatile asset, the company has turned a mined resource into a foundation for growth and innovation.

This article was written by Jared Kirui at www.financemagnates.com.