Starting today, investors can engage with a new layer of leverage and risk management, signaling another milestone for institutional Bitcoin adoption.

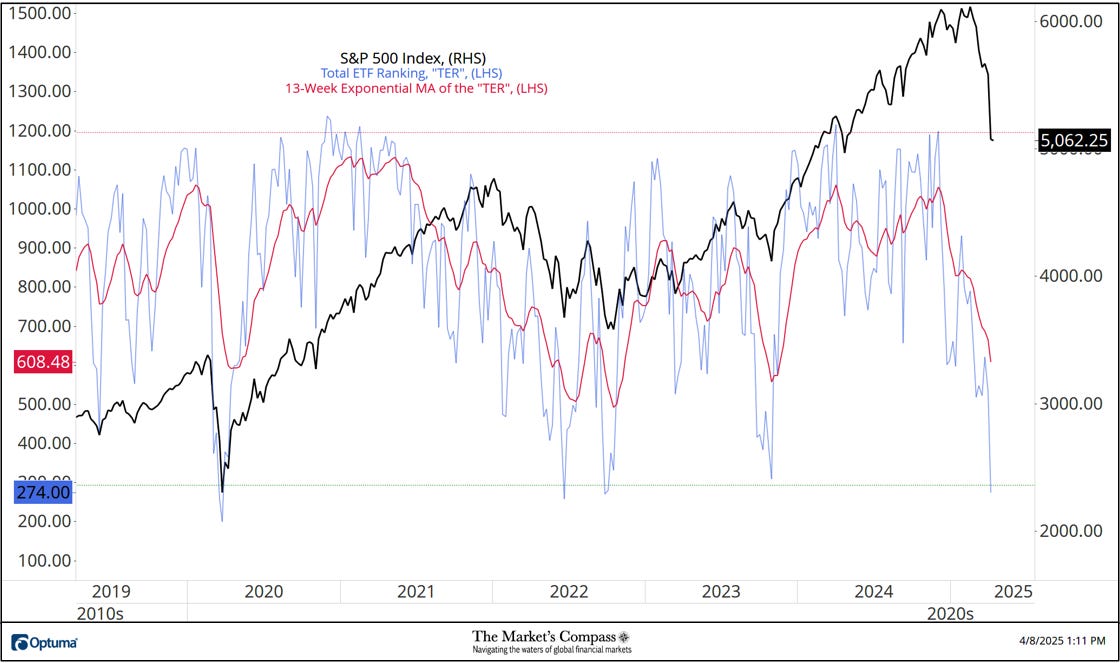

Analyst Eric Balchunas tweeted, “A few hundred million so far in options volume on $IBIT (a ton for Day One).. here’s a rank of the contracts by volume, it’s almost all calls. Seems very bullish, esp the Dec20th C100, which is basically betting price of btc will double in the next month.”

Source: X

Options: A New Frontier for Bitcoin ETFsNasdaq’s Head of ETP Listings, Alison Hennessy, confirmed earlier in the week on Bloomberg TV that options trading on IBIT would begin imminently. “Our intent at Nasdaq is to list and trade these options as early as tomorrow,” she said. The OCC, which serves as the global epicenter for equity and derivatives clearing, is prepared to manage the settlement and risk processes for these novel options, backed by a green light from the CFTC.

The introduction of options for spot Bitcoin ETFs offers a dual advantage. First, it enhances liquidity, a crucial factor for institutional participation. Second, it introduces a level of risk management previously inaccessible to ETF investors. Analysts are optimistic but cautious, noting that while options improve accessibility, they could also magnify market volatility.

A Booming MarketBitcoin’s stellar performance this year—surging past $93,800—has fueled demand for spot Bitcoin ETFs. BlackRock’s IBIT stands out, raking in $29 billion of the $27 billion net inflows into this asset class. The ETF’s success underscores Wall Street’s growing appetite for regulated Bitcoin exposure.

With options now in play, market analysts anticipate a surge in institutional activity. The ability to hedge positions and leverage market moves offers a sophisticated toolkit for investors navigating Bitcoin’s often-turbulent waters.

Source: Brave New Coin Bitcoin Liquid Index

Options: The Institutional MagnetOptions are financial derivatives allowing investors to buy or sell an asset at a set price within a specific timeframe. They are lauded for their flexibility, offering pathways to both speculative gains and risk mitigation. For Bitcoin ETFs, options could be the linchpin that turns Wall Street’s cautious interest into full-throttle adoption.

Bloomberg’s James Seyffart believes the rollout will be swift, saying, “It’s likely these things start trading this week. All regulatory hurdles are cleared; now it’s about crossing the t’s and dotting the i’s.”

The Bigger PictureThe SEC’s approval of Bitcoin ETF options marks a pivotal moment in the crypto market’s regulatory evolution. With Wall Street giants like BlackRock leading the charge, Bitcoin’s transition from fringe asset to financial mainstay seems inevitable. However, as the market matures, questions linger about how these new instruments will shape Bitcoin’s price dynamics.

For now, the buzz is palpable. Nasdaq’s rollout of options trading could usher in a new era of crypto-financialization, one where Bitcoin firmly establishes its place in institutional portfolios. Whether this development will stabilize or destabilize prices remains a key narrative to watch.

On X, Jeff Park, head of Alpha Strategies at Bitwise, published a lengthy document explaining why he sees Options approval as a gamer changer. His thoughts are summarized below.

Why Bitcoin ETF Options Are Game-ChangingThe author outlines three key points to argue that options trading for Bitcoin ETFs introduces revolutionary shifts in the financial landscape:

Existing Bitcoin Options (Deribit, LedgerX, CME) Are Not Comparable to ETF Options: Platforms like Deribit and LedgerX lack central guarantors, limiting their appeal for institutional adoption. Current Bitcoin futures on CME (24% market share) also don’t solve capital efficiency issues. ETF options bring multi-asset portfolio cross-margining, allowing capital-efficient trades across products like bonds, equities, and gold ETFs. This creates the potential for “free leverage.” Paper Bitcoin Dilutes Volatility, But ETF Options May Increase It: Derivatives backed by USD collateral (like futures) don’t hold real Bitcoin, which mutes volatility. Bitcoin ETF options differ as they create synthetic flows while potentially boosting market volatility. Selling calls is capital intensive compared to buying, creating asymmetric risks that could trigger arbitrage opportunities. Margins for short calls expose sellers to infinite losses, which could lead to more volatile markets. “You Can’t Short Squeeze a Trillion-Dollar Asset” Myth: Despite Bitcoin’s high market cap, options amplify leverage in unique ways. The example of a leveraged position in Deribit ($1400 premium, 10x delta on futures) demonstrates how even small capital injections can move the market, potentially enabling significant upward pressure. Bitcoin ETF Options Will Reshape the Financial MarketJeff then dives deeper into why Bitcoin ETF options are transformative, introducing several important concepts:

Fractional Banking of Bitcoin’s Notional Value: Bitcoin’s capped supply limits its leverage capabilities in current setups. ETF options introduce synthetic exposure in a regulated environment. This ensures the OCC mitigates counterparty risks, allowing Bitcoin’s notional value to multiply through leverage without compromising systemic stability. Duration-Based Portfolio Exposure: Unlike daily options (e.g., zero-days-to-expiration trades), ETF options offer long-term exposure through dated calls and puts. This allows retail and institutional investors to create portfolios with greater risk management, hedging strategies, and cost-efficiency. Volatility Dynamics: Bitcoin’s inherent volatility is key to its appeal but also its complexity. Bitcoin options will introduce “negative vanna” – a scenario where volatility and spot prices rise together, creating explosive feedback loops. Gamma squeezes, already seen in stocks like GME, will be amplified here, as Bitcoin ETF options lack dilution mechanisms. This means dealers will continually hedge by buying more Bitcoin, increasing upward pressure. The Leverage Effect: Bitcoin’s supply constraints mean it behaves differently from traditional commodities or equities. Unlike stocks, Bitcoin can’t issue more supply to ease demand, ensuring leverage flows directly into price action. This could lead to exponential rallies as ETF options funnel more capital into constrained supply markets. First-Ever True Financialization of a Scarce Digital Asset: The Bitcoin ETF options market will operate within a fully regulated framework, ensuring transparent and compliant trading. The introduction of synthetic leverage via ETF options will fuel Bitcoin’s appeal as both a speculative and hedge asset, while the system remains decentralized. Key TakeawayThis development represents a moment in financial markets. It will not only enhance Bitcoin’s role as a store of value but also unlock unprecedented trading mechanics for a decentralized asset in a regulated environment. Bring it on.