A federal court has ruled that more than 94,000 Bitcoin, seized in connection with the high-profile 2016 hack of cryptocurrency exchange Bitfinex, must be returned to the platform. The move comes after years of legal wrangling and investigation, culminating in what the U.S. Department of Justice (DOJ) has called the largest asset seizure in its history.

The 2016 breach saw hackers divert nearly 120,000 Bitcoin—worth approximately $71 million at the time—away from the Hong Kong-based exchange. Today, those coins are valued at close to $12 billion, owing to Bitcoin’s surging price. Roughly $9 billion of the stolen cryptocurrency has been recovered, according to Tuesday’s court filing.

In the filing, DOJ officials stated that Bitfinex, rather than its customers, qualifies for the return of the seized assets. The government’s position drew from its conclusion that there are no identifiable “victims” under relevant U.S. law for the particular offenses of conviction—money laundering and conspiracy—since the statute of limitations for the hack itself had expired. The filing reads, “For the foregoing reasons, there is no ‘victim’ for the specific offenses of conviction in this proceeding,” and further cites “the complexity of the laundering transactions” as a reason that not all stolen coins could be recovered.

Laundering Scheme and ArrestsTuesday’s ruling also sheds new light on the involvement of Ilya “Dutch” Lichtenstein and his wife, rapper Heather “Razzlekhan” Morgan, who pleaded guilty last year to laundering funds from the Bitfinex heist. Lichtenstein admitted to orchestrating the hack itself and is serving a 60-month prison sentence for his role. Morgan, best known by her rap persona “Razzlekhan,” was sentenced to 18 months for conspiring to launder the stolen Bitcoin. The DOJ has credited both individuals’ cooperation with helping recover a significant portion of the funds.

Though Morgan’s prison term begins this month, the self-styled entrepreneur has continued her musical pursuits. She recently released a track and video titled “Razzlekhan vs. The United States,” which she described in a statement as a “misfits’ anthem.” Morgan has stated the song is based on her experiences stemming from the case: “The track is about fighting the odds and standing up for misfits like me,” she said.

Impact on Bitfinex CustomersFollowing the breach in 2016, Bitfinex “generalized” the losses across all customer accounts, effectively reducing each holder’s balance by 36%. The exchange provided BFX tokens—later supplemented by Recovery Right Tokens (RRT)—as compensation, allowing customers to redeem them for cash or potentially convert them into shares in parent company iFinex. Bitfinex maintains that most customers have been “made whole,” but some account holders dispute this claim, especially since the subsequent rise in Bitcoin’s price far exceeded the value of the tokens.

Now, with the court ordering the return of 94,643 Bitcoin to Bitfinex, questions over who is entitled to a share of the recovered assets have reignited. The DOJ has set up a website to gather statements from those who believe they qualify as victims, and third parties have until January 28, 2025, to file objections or assert a claim. Legal observers suggest the restitution hearing—scheduled for February 25, 2025—could set a precedent for how courts address victim status in cryptocurrency theft cases.

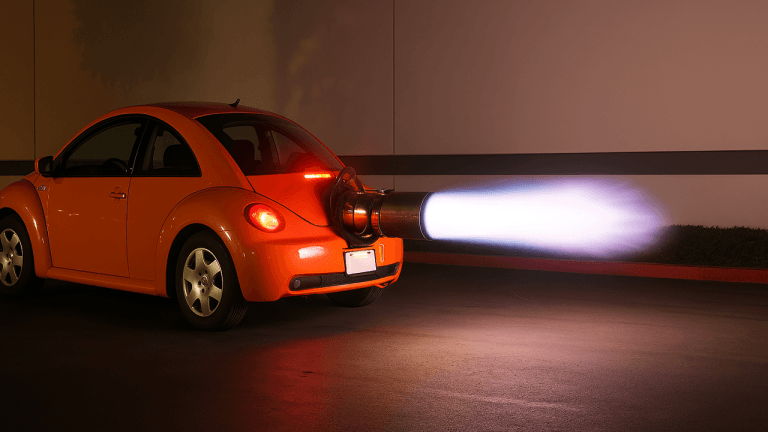

The Bitcoin must be returned to Bitfinex, Source: X

Future Proceedings

In addition to the primary sum earmarked for Bitfinex, authorities noted that a “third-party ancillary forfeiture proceeding” is in place to manage crypto that remains unrecovered or linked to money laundering activities. The government’s stance holds that any remaining laundered assets must be dealt with separately, allowing those who wish to stake a claim—such as certain Bitfinex customers—to argue their case in court.

Bitfinex has reaffirmed its commitment to allocating any recovered funds to redeem the remaining RRT tokens, stating it is the “sole victim” of the 2016 hack for legal purposes. “We have always believed recovery of the stolen Bitcoin was possible,” a company representative said. “We will continue working diligently to distribute recovered assets in an equitable manner.”

Observers say the forthcoming restitution hearing will be crucial. If the court sides fully with Bitfinex and grants it sole ownership of the returned Bitcoin, it could mean limited recourse for account holders who saw their balances cut nearly a decade ago.

The El Salvador ConnectionTether and Bitfinex Chief Executive Paolo Ardoino is yet to comment on the proposed return of the bitcoin. However, he told Reuters this week that Tether will relocate to El Salvador. This would mark the first time the company maintains a dedicated office space. While Tether employs more than 100 staff globally—most working remotely—Ardoino and several top executives, including co-founders, intend to live in El Salvador.

“This move to El Salvador will be the first time we’re going to have a physical headquarters,” Ardoino said. “The country’s progressive policies and supportive regulatory environment closely match our vision to foster cryptocurrency adoption in emerging markets.”