Money services providers could lose $400 million a year in commissions for remittances thanks to bitcoin, increasing Salvadorans’ money.

El Salvador’s bitcoin adoption will increase the wealth of its people while diminishing the commission fees paid out to intermediaries, CNBC reported. President Nayib Bukele estimates that companies like Western Union and MoneyGram will lose about $400 million a year in remittance fees due to the country’s bitcoin adoption.

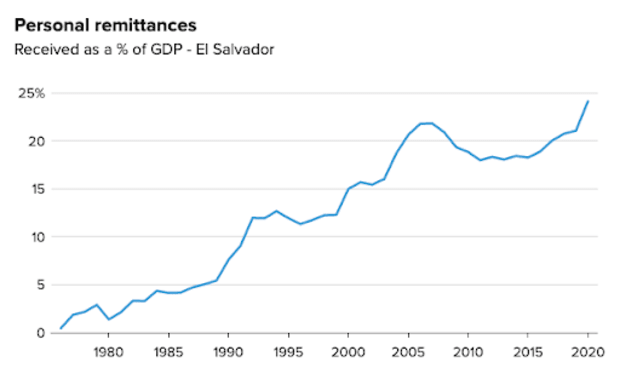

Cross-border remittance inflows account for a substantial portion of El Salvador’s gross domestic product (GDP), nearly 25%. Major money service providers capture that yearly movement by charging hefty fees for sending and receiving transactions. Many Salvadorans rely on money sent from family members living abroad to help pay living expenses or increase their quality of life.

Cross-border remittance inflows as a percentage of El Salvador’s GDP. SourceHowever, since officially adopting bitcoin as a lawful currency on September 7, El Salvador now provides a better option for its citizens looking to send or receive money overseas. Salvadorans are now empowered to do what they wish with their money without having to wait in lines, ask for permission, or wait several business days by leveraging the Bitcoin and Lightning networks to send and receive instant, cheap payments worldwide.

“Remittances are one area where the status quo in our legacy financial system is terrible, with extraordinarily high fees leveled at populations that can ill afford them,” Matt Hougan, Chief Investment Officer of Bitwise Asset Management, told CNBC. “It’s a worn-out Twitter saying, but bitcoin really does fix this.”

Bitcoin is providing hope and empowerment to millions of people in El Salvador, as well as helping them save money. Jamie García, who fled El Salvador for Canada at the age of 11 after having his house bombed by rebels, told CNBC how big of a hassle it was to use Western Union for sending some money to his family in the Central American country.

“In this day and age, it is wild that I had to go to a physical Western Union office, give them actual cash, and then hand them another $25 on top of that, before they would send my money over,” García said. “And then, of course, it takes three days for it to actually arrive in El Salvador.”

However, García commented that although there were huge inconveniences on his end, he worried the most about the procedure his family members had to endure for picking up the cash.

“They have to take a bus to go to a physical location to pick it up, and there are gangs that hang out around those offices,” said García. “They know what people are going there for, and they basically rob them.”

But now, the households that receive regular remittances, which account for over half of their total income, have a cheaper and more secure option for transacting money. Bitcoin has the power to free García from his inconveniences and worries as well as provide security for his family. The permissionless peer-to-peer monetary network requires only a mobile phone and an average internet connection to enable instant, secure, sovereign global money transmission while rendering cumbersome companies like Western Union useless for that use case.