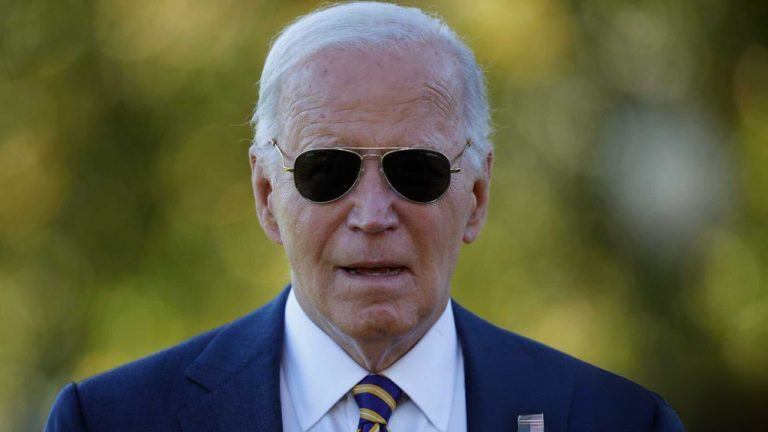

Billionaire entrepreneur Mark Cuban, best known for owning the NBA’s Dallas Mavericks and his role on the television show Shark Tank, has reiterated his preference for Bitcoin over gold as an economic hedge amidst growing financial uncertainties.

In a recent statement, Cuban emphasized Bitcoin’s advantages, stating, “I think it has more value,” and revealed his preference to hold Bitcoin rather than gold in the event of an economic meltdown. This viewpoint aligns with the emerging narrative of Bitcoin being considered “digital gold”—a decentralized store of wealth that avoids the pitfalls of centralized financial systems.

Unlike gold, which has traditionally been viewed as a safe haven during economic turmoil, Bitcoin offers distinct benefits such as portability, divisibility, and the ease of transferring value across borders without physical limitations. These technological advantages make Bitcoin an increasingly attractive alternative in times of uncertainty. Cuban’s stance highlights Bitcoin’s potential to serve not only as a store of value but also as a functional currency.

Mark Cuban’s confidence in Bitcoin was further reflected in a social media update on platform X, where the account Watcher. Guru shared his recent remarks: JUST IN: Billionaire Mark Cuban says he’d rather own Bitcoin than gold if something bad happens to the economy. “I think it has more value.”

Bitcoin has consistently outperformed Gold since its inception: Source: CaseBitcoin

In 2024, Cuban reaffirmed his support for major cryptocurrencies like Bitcoin and Ethereum while cautioning investors against speculative “meme coins,” which he likened to a game of musical chairs due to their volatility and lack of long-term stability. His steadfast support for Bitcoin has only intensified, positioning him as a prominent advocate for the cryptocurrency.

Changing Investor PerceptionsCuban’s preference for Bitcoin over gold reflects a significant transformation in investor perceptions, particularly as concerns over inflation and potential global financial disruptions grow. Bitcoin is increasingly seen as a hedge against not only inflation but also against the inertia of traditional financial institutions in adopting new technologies. This shift is driven by Bitcoin’s inherent features, such as its divisibility and the ability to facilitate international transactions seamlessly.

Gold, while historically esteemed for its ability to retain value during economic downturns, presents practical challenges. Cuban highlighted the impracticality of using gold in everyday transactions, noting its physical bulk and susceptibility to theft. “People aren’t gonna walk around with gold bars. ‘Oh, look, he owns gold.’ Bam! ‘Now I own gold,’” Cuban remarked. He contrasted this with Bitcoin’s flexibility, which allows for fractional ownership and easier transferability, enhancing its utility as both a store of value and a medium of exchange.

Despite Bitcoin’s volatility, proponents like Cuban argue that its long-term potential outweighs the risks. Financial expert Suze Orman echoed a similar sentiment, suggesting that younger generations’ growing interest in digital assets could drive Bitcoin’s adoption and appreciation over time.