This ambitious initiative aims to strengthen the company’s balance sheet and accelerate its already aggressive Bitcoin acquisition strategy.

Details of the OfferingThe offering was announced on January 3 for sales, which are expected to take place in the first quarter of 2025, subject to market conditions. Proceeds of this capital increase will be used, among others, to enhance the company’s financial position and buy more Bitcoin. MicroStrategy’s preferred stock will bear characteristics including its conversion into Class A common stock, the cash dividend paid on it, and its redemption.

Source: X

Leading from the front in carving out this strategy has been Michael Saylor, the executive chairman of the company and one of the most vocal Bitcoin champions. His firm has acquired 446,400 BTC valued at approximately $43.9 billion, or an average price of $62,396 apiece. Meanwhile, the current market price of BTC stands at $97,700, representing an unrealized appreciation of 56.8% against the cost price of MicroStrategy’s acquisition.

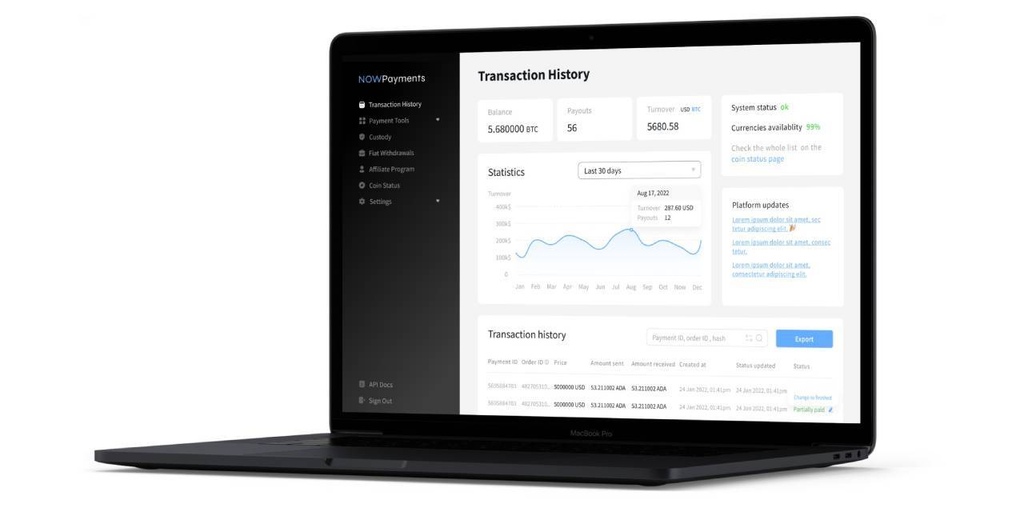

Early on Monday morning, Saylor posted the following portfolio tracker. It’s a signal that he is about to announce another large Bitcoin buy.

Source: X

Part of a Larger StrategyThis stock sale is part of MicroStrategy’s larger “21/21 Plan,” whereby the company wants to sell $42 billion in equity and fixed-income instruments over three years. Hence, this now is 45% complete, well underway, to underline the company’s confidence in Bitcoin for the longer term as a store of value and an inflation hedge.

Bitcoin (BTC) price chart. Source:Bitcoin Liquid Index (BLX) via Brave New Coin

MicroStrategy continues to buy more Bitcoin through purchases that are non-stop. In December 2024, it bought more than 60,000 BTC. Of those, 21,550 BTC were purchased on December 9 for an average of $98,783 apiece.

Market ImpactThe announcement comes when volatility is rife in the cryptocurrency markets. Indeed, Bitcoin is well off its highs of late, most recently finding resistance around $100,000, trading about 10% below its all-time high of $108,268, touched in December 2024. Yet MicroStrategy’s news didn’t do the stock: MSTR rose 13% to $339.60 on January 3, up 438% from a year earlier.

A Pioneering Strategy with RisksWith its Bitcoin-focused foray, MicroStrategy has broken the ice in corporate treasury management. Through its substantial commitment of resources to Bitcoin, the company has redefined how businesses view digital assets. Yet, the volatility of the digital asset remains a concern, along with regulatory uncertainty.

The offering also showcases the innovative financing mechanisms that MicroStrategy employs in raising capital to fund the purchase of cryptocurrencies through convertible notes and perpetual preferred stock. This provides flexibility with a minimum dilution of shareholder value.

The Road AheadAs Bitcoin adoption continues to grow, MicroStrategy’s bold initiatives may pave the way for other corporations to explore similar strategies. The firm plans to hold a shareholder meeting later this year to discuss increasing authorized stock to support the proposed offerings, a move that could further cement its position as a leader in corporate Bitcoin investment.

Whether this $2 billion offering will proceed depends on favorable market conditions, but its announcement alone reinforces MicroStrategy’s unwavering commitment to Bitcoin as a cornerstone of its corporate strategy.

Finally, if this image of Michael Saylor with Eric Trump at Mar-a-Lago doesn’t make you bullish for Bitcoin, a Bitcoin Strategic Reserve and the Bitcoin price in 2025, we’re not sure what will….

Source: X