Analyzing Michael Saylor’s mega Bitcoin-driven strategy and its critics.

The move made it instantly the most loved and hated Bitcoin investment vehicle in many quarters. The strategy pays dividends for the moment, but the longer-run sustainability and implication for shareholders and the greater market is a question that still begs an answer.

A Bold, Bitcoin-Fueled VisionMichael Saylor, co-founder and chairman of cryptocurrency software company MicroStrategy, has disclosed an ambitious plan to put to work the company’s substantial holdings in Bitcoin, currently at close to 440,000 BTC. As of 2024, these hold nearly all, or about $37.6 billion, of the value represented by the firm’s market capitalization. The Bitcoin-driven approach in force has catapulted it to new highs, with its market capitalization nearing $100 billion—something quite out of the ordinary within the technology industry.

Saylor further clarified the strategy followed by the firm in optimizing its capital structure in an interview with Bloomberg Television and termed it “intelligent leverage.” Saylor also confirmed that issuing convertible bonds at MicroStrategy has enabled the firm to finance several billion in Bitcoin purchases. He stated, “We have $7.2 billion in convertible bonds, with $4 billion effectively acting as equity through the strike price and call price.” This strategy, he added, aims to build more leverage that benefits shareholders while also supporting the company’s Bitcoin-driven vision.

Source: X

As part of its capital-raising efforts, MicroStrategy issued $6.2 billion in convertible bonds this year alone, attracting interest from hedge funds. These funds employ convertible arbitrage strategies, betting on the company’s volatility while helping to sustain its leverage. Despite the criticism, MicroStrategy’s aggressive strategy has resulted in a remarkable surge in its stock price, which has soared by around 500% over the past year, far outpacing Bitcoin’s gains.

The Critics: Is MicroStrategy’s Approach Sustainable?Despite its success, MicroStrategy’s strategy has been labeled by some analysts as an unsustainable “Ponzi scheme.” Jacob King, a contributor to the Whalewire newsletter, is among the most vocal critics of the company’s Bitcoin-centric approach. King argues that MicroStrategy’s model is built on a dangerous feedback loop: the company issues debt or equity to purchase Bitcoin, driving up the cryptocurrency’s price, which in turn boosts MicroStrategy’s market capitalization. This, according to King, allows the company to raise more capital for further Bitcoin acquisitions.

Source: X

However, King warns that this cycle is entirely dependent on Bitcoin’s price continuing to rise. “When Bitcoin stagnates or crashes—watch the entire structure collapse,” King wrote on X. He likens the company’s dependence on Bitcoin’s value to an addict’s reliance on their supply, describing the strategy as “pure desperation.”

Source: Jacob King via X

This critique is compounded by Saylor’s history of conflicting statements. In 2013, he famously dismissed Bitcoin as “useless,” but in recent years, he has committed MicroStrategy’s future to the cryptocurrency, making it the centerpiece of the company’s strategy. King’s analysis points to this shift as evidence of a lack of long-term planning and foresight.

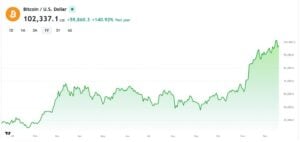

Opportunities and Risks in Bitcoin’s Bull RunThe soaring price of Bitcoin has certainly worked in MicroStrategy’s favor, with the cryptocurrency’s value recently surging past $100,000, contributing to a 120% increase in its value this year alone. The sudden spike gave a big thrust to the firm’s portfolio and further supported its strategy, some investors said. MicroStrategy, for example, has acquired an additional 249,850 BTC from 2024 to date, taking its total holding to 439,000 BTC, way above that held by its nearest competitor, Marathon Digital.

But with Bitcoin’s continued rise comes a growing set of risks attached to the heavy reliance of MicroStrategy on its price. The stock has surged—to be sure, highly volatile, moving in concert with Bitcoin’s ups and downs. The market value of MicroStrategy may be significantly impacted if Bitcoin’s value declines or remains unchanged. This is due to the fact that the business is very dependent on Bitcoin’s ongoing expansion.

MicroStrategy is certain that its Bitcoin approach will benefit shareholders in the long run, despite these risks. The company’s visibility and appeal may increase if it is included in the Nasdaq 100 Index, which may help draw institutional investors.

A Fragile Future?While MicroStrategy’s Bitcoin strategy has undoubtedly made it one of the most closely watched companies in the cryptocurrency space, its future remains uncertain. For now, the company continues to reap the rewards of Bitcoin’s surge, but the question remains: how long can this strategy sustain itself? If Bitcoin’s price were to fall significantly, the company’s leverage and market cap could be at risk, leaving investors to face the consequences.

As Saylor continues to advocate for Bitcoin’s integration into major tech companies—most notably Microsoft—his vision for the future of cryptocurrency remains steadfast. However, as critics like Jacob King argue, the risks associated with MicroStrategy’s strategy cannot be ignored. Only time will tell whether this bold experiment will pay off or if it will ultimately collapse under its own weight.