HODL waves data show that bitcoin demand is outpacing supply, indicating an upcoming BTC price rise.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

We have been covering the bullish bitcoin supply dynamics extremely closely over the last few months, as we believe this to be the fundamental driver of price action in this market. The monetization process of bitcoin unfolds as adopters acquire bitcoin for a price that they believe to be undervalued and HODL until this is no longer believed to be true. This act reduces the free float or supply available on the market, and as additional participants also wish to hold the asset, less satoshis are able to go around. Simple supply and demand tells us that only one thing can occur: the price of bitcoin rises.

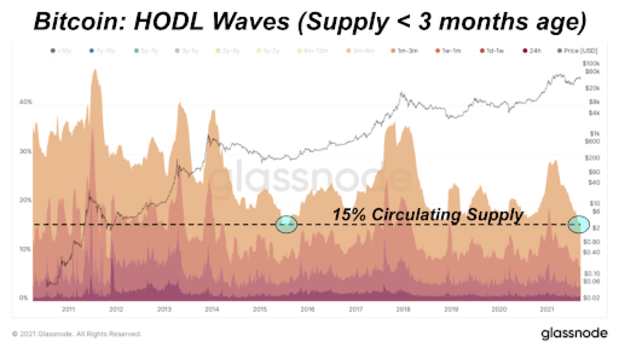

Today we will review some recent HODL waves data for an up-close view on HODLer activity.

The percentage of the bitcoin supply that has moved within the last three months is tied for an all-time low, with the other instance occurring at the bottom of the 2015 bear market. Said differently, 85% of the circulating bitcoin supply has not changed addresses in the last three months, an all-time high (tied with the instance in 2015).

Below is the same data but viewed in opposite ways:

Bitcoin: HODL Waves, Supply Active During Previous Three Months Bitcoin: HODL Waves, Supply Active Greater Than Three MonthsSimilarly, supply last moved more than five years ago has hit an all-time high, coming in at 22.76% of circulating supply. While undoubtedly some of this can be attributed to lost coins (see: increasingly-large purple band of supply last moved greater than 10 years ago), nevertheless this contributes to the supply-side dynamics currently playing out in the market. The supply of coins that have not moved in over 10 years is approximately 2.25 million BTC, and a large proportion of these coins can be presumably counted as lost, including Satoshi’s estimated 1 million plus BTC stash (which has never moved).

Bitcoin: HODL Waves, Supply Active Greater Than Five YearsThe bitcoin thesis is simple:

We are witnessing the rise of an emerging global monetary asset, the likes of which none of us have ever seen. The monetization process of bitcoin is an opportunity that only presents itself once, and from a game-theoretic perspective, your only choice is to play (acquire and HODL bitcoin).