Bitcoin will ultimately “fix the money” and enable world peace, but we can bring this future about more quickly through contributions to the Bitcoin charity.

In July 2021, during an event featuring Cathie Wood, Jack Dorsey and Elon Musk, the panelists were asked: “What do you hope for Bitcoin?”

Dorsey replied, “My hope is that it creates world peace or helps create world peace.”

While many will laugh at Dorsey and call him naive, those who truly understand the long-term implications of Bitcoin know that this is a perfectly realistic hope. In fact, it doesn’t need to be a hope, there is a charity that exists that can hurry Bitcoin along on its path to “fixing this.”

A little while back, somebody asked me about dollar-cost averaging (DCA) as an investment strategy. I replied, “What’s dollar-cost averaging?” They answered, almost dumbfounded, “You know, DCA, that thing you’ve hinged your entire online persona on and bang on about multiple times daily.”

Flabbergasted, I said, “Dollar-cost averaging? I thought DCA stood for “daily charitable act!”

I firmly believe that a small daily act of charity, done by everyone, within their means, would truly make this a beautiful world. But while many already do this in some way, it seems that the more we’ve been giving, the worse the problems seem to get. Inequality is getting worse, the environment is becoming more polluted, more species are becoming extinct and endangered, hundreds of millions of humans are still hungry and without access to even basic toilets and sanitation. This can’t keep dragging on forever — a sustainable long-term solution needs to be found now. This means no more band-aid solutions and aiming our charitable efforts at solving the root causes of the problems, such as the Cantillon effect, and ending this painful cycle of misery for so many, once and for all.

In a recent podcast with Stephan Livera, I made the case that Bitcoin may be the biggest charitable and humanitarian movement in human history. I will spell out the case in far more specific detail here.

To do this, I will first define what charity is, as well as discuss the contemporary state of global charity. This will include some data on the world’s biggest charities in terms of revenue and impact. We will then have a look at the Bitcoin charity, along with its mission, structure and the benefits it provides both its beneficiaries and its benefactors.

What Is Charity?We all know what charity or “a charity” is, but to make the rest of this piece possible, I will turn to the Wikipedia page on charity to get the broadest definitions. To that end, charity can be many things; “a non-profit organisation whose primary objectives are philanthropy and social well-being of persons,” “a practice of being benevolent, giving and sharing,” or a “religious virtue and concept of unlimited love and kindness.”

In the past, I have written about Bitcoin as a startup organization and about Bitcoin and religion to use as mental frameworks to (inaccurately and incompletely!) help explain or describe Bitcoin, so the leap to “Bitcoin as a charity” isn’t a far one to make, especially considering the broad Wikipedia definitions we saw earlier. Let’s have a look at these three definitions closer:

With regards to being a non-profit organization, in my startup framework piece I wrote:

“An organization is defined as ‘an organized group of people with a particular purpose.’ If that’s the case, then Bitcoin is a well-oiled ‘un-organization’ with founders but no CEOs, many volunteers but no employees, and provably non-diluting equity, available to anyone who is willing to trade their energy for it.”

Obviously, “Bitcoin” makes no profit, so we can tick that box. In terms of the “primary objectives are philanthropy and social well-being of persons” definition, I lazily look to the abstract of the Bitcoin white paper, verbatim, and see the following objectives:

“[A]llow online payments to be sent directly from one party to another without going through a financial institution”“[N]odes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone”To rephrase the above in layman's terms, everybody has the right to send and receive value, and to store value, with absolute, energy-backed certainty — no exceptions. Coupling this with fixed supply (which is, funnily, not explicitly mentioned in the white paper), and this may be the only possible way to truly maximize the economic, and by extension, social, well-being of all people around the world.

I won’t be able to dive deep into the human element of Bitcoin to the extent that it deserves, but followers of my dear colleague Alex Gladstein will know the depth of Bitcoin’s humanitarian power, especially among the down-trodden. There is legitimate love and kindness in the Bitcoin community, and some of the efforts we are seeing around the world in Cuba, El Salvador, Nigeria and many other places clearly demonstrate this. I would strongly recommend spending a few hours on a slow Sunday morning going through Gladstein’s entire catalogue here on Bitcoin Magazine to comprehend the full extent.

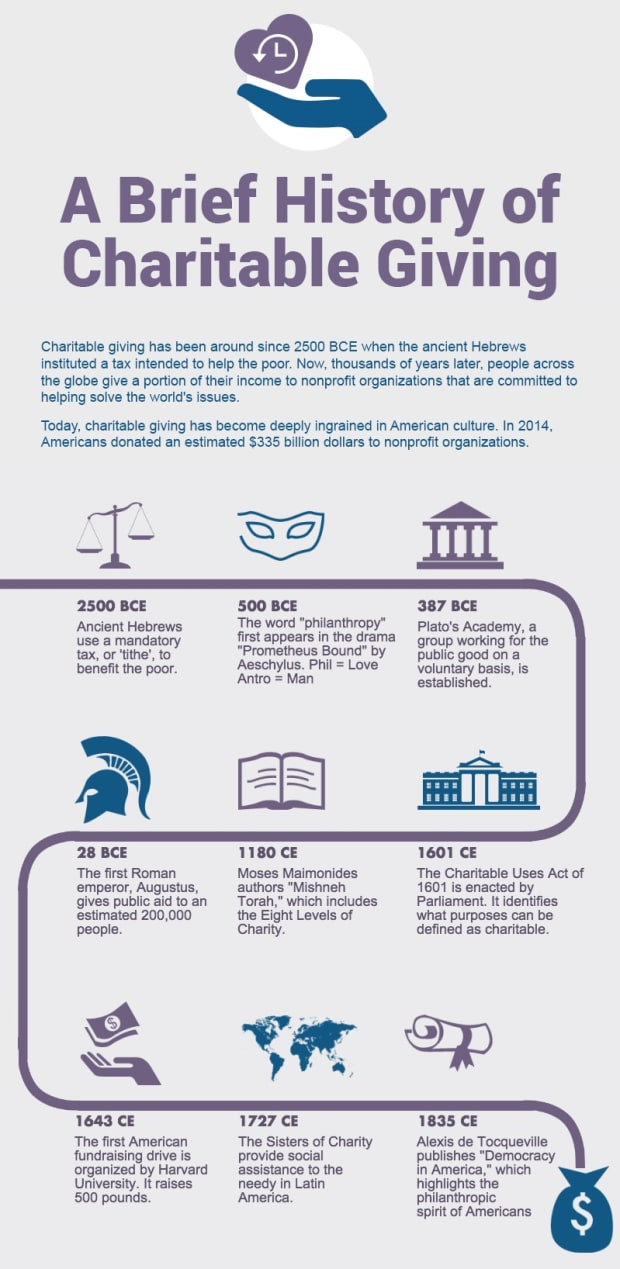

The History Of CharityCharity is not a new thing, with its religious roots stretching back over 4,500 years, and secular roots over 2,500, as shown in the infographic below.

In terms of religious charity, the tithe (or tenth, or 10%) features in all Abrahamic religions, as well as Sikhism, often on a mandatory basis. There is even a secular tithing movement, Giving What We Can, which encourages their members to commit to tithe 10% of their income to the most effective charities.

By the end of this piece, I hope to show that “donating” 10% of your income to Bitcoin is the most charitable activity in which you could ever partake. Indeed, “10% of your income into Bitcoin” is a growing meme, and I’ve previously demonstrated the mechanics of how a relatively small group of dedicated Bitcoin tithers could indeed bring about a $20 trillion bitcoin market, and by extension, the significant weakening (possibly destruction) of the proof-of-stake legacy fiat system, resulting in world peace.

Indeed, “Bitcoin Is The Successor To Violence.”

Figure one: A brief history of charity. Source: Winspire. The Global State Of CharityAs we can see from the numbers presented in the 2018 Harvard “Global Philanthropy Report” in the three figures below, despite a huge geographical gap in data, there is a minimum of a quarter of a million charitable foundations in the world, with at least $1.5 trillion in assets, that collectively spend around 10% of their assets, or $150 billion each year.

Figure two: Number of charitable foundations around the world Figure three: Charitable foundation assets Figure four: Foundation spend rateSo, we know that $150 billion is spent by foundations globally, but how much is raised? The Charities Aid Foundation assesses global charitable giving as a percentage of GDP. As shown in figure five below, this amounts to over $400 billion dollars given per year, based on data from almost 80% of world GDP. Yes, that’s right, more than $250 billion of raised funds, over 60%, unfortunately goes toward simply shoring up the balance sheets of foundations.

Do I actually need to say anything more about the effectiveness of “Big Charity”?

Figure five: Donations as a percentage of GDP and total donatedIt pains me to say it, but donating to basically any centralized charity is a waste of time and money at best, or perpetuating continuing and increased suffering at worst. These high-overhead charities will never solve any social, economic or environmental problems so long as the proof-of-stake legacy system and Cantillon effect are allowed to proliferate. Focus on the Bitcoin charity, and soon enough, no one in the world will be starving. Obviously, this sounds ridiculous now, but by the end of this piece, I hope that it won’t.

If the above level of giving was put into Bitcoin each year, well over $1 billion per day, then we would see a $1 million bitcoin price very quickly, and the power of the Bitcoin charity would be on display for all to witness and take part in.

The Bitcoin CharityFor well over a decade, the Bitcoin charity has been hard at work, rescuing the world from the social, economic and environmental effects of proof-of-stake legacy systems, such as governments, central banking and finance, as well as the military industrial complex.

We’ve already spoken about the structure and mission of the organization earlier in this piece, so let’s talk about the finer details of how the charity actually functions in practice.

How To Donate To The Bitcoin Charity (And Why)The typical charitable foundation follows a centralized model, in which the foundation raises donor funds and distributes parts of these funds in pursuit of the primary objective of the foundation. I earlier defined Bitcoin as a “well-oiled un-organization,” so obviously, it would be impossible for “Bitcoin” to even collect donations, let alone distribute them. So how does one “donate” and how is the benefit accrued?

Obviously, when people say “Bitcoin fixes this,” it doesn’t mean that Bitcoin is the solution to literally every single problem in the world. Indeed, the spirit of the saying is more along the lines of “if we had honest money, the world would be a far more honest place.”

There is a thesis, and it is a strong one, that only a move to a Bitcoin standard would bring the peace, sustainability and economic prosperity required for our civilization to endure. But there is also the harsh reality that, at only a fickle $50,000 per coin, a tiny $1 trillion in market cap, bitcoin pales in comparison to the hundreds of trillions of dollars in global wealth, and hundreds of trillions more in derivative products, and Bitcoin’s major benefits will not and cannot accrue until it is no longer fickle or tiny in terms of price.

This is definitely not to say that millions of people are not already reaping huge benefits, but indeed, these are only being reaped because Bitcoin has already grown to a particular size. It would be far less beneficial to Salvadorans in El Zonte if bitcoin was worth $10 and it fluctuated by 90% every day. People need to accept that the price, while being the least interesting thing about Bitcoin, is the single metric on which it is judged by outsiders, and more importantly, why it is either demanded or rejected. When it’s going up, people want it; when it’s going down, people fear it. If they only knew!

To put it simply, the way to donate to the Bitcoin charity is by increasing demand for bitcoin in any way you are able to, on a consistent basis. Charities prefer small regular donations as opposed to lump sums, as it allows them stability and predictability. This is no different to when people lump into bitcoin, causing huge, short-term price spikes, only for it to list lazily back to its “real” level over time — sometimes an 85% correction. Again, this is not useful for Salvadorans. We saw this on September 7, “Bitcoin Day” in El Salvador, when new Bitcoin adopters were subject to a 20% wealth drop in under an hour, followed by a 10% recovery in four hours, on their first day. I’m sure that inspired a ton of confidence in new Salvadoran Bitcoiners moving forward.

People get excited for new things, like all getting together on one specific day, with one specific meme lump sum “in support of El Salvador” (“let’s all buy $30 of bitcoin every September 7t”), but as shown on September 7, 2021, this is the absolute worst possible thing you can do. The best thing is to increase demand for bitcoin on a daily basis, consistently and predictably. One-off buys can be worse than useless. “Upward stability” is the aim of the game

In terms of “increasing demand for bitcoin,” this could be via protocol and product development to make Bitcoin more useful and usable, or it could be education, evangelism, entertainment or enterprise for others. Some increase demand by getting paid in bitcoin, or migrating fiat-pay to bitcoin via automated regular buying. Finally, we have the bedrock of demand itself, the miners. Importantly, “creation of supply” should be avoided at all costs, and counter intuitively, the more expensive bitcoin gets, the less likely it is to be exchanged for fiat currency, and the more likely that a circular economy will have formed.

By simply increasing demand for bitcoin, you will increase future demand for bitcoin — a virtuous cycle of increasing demand. This almost sounds stupid to say. The more you demand it, the more everyone else will too, and the better it will become. This is a universal law — the more a product is demanded, the better it gets. With an upwardly-stable price, the benefits start to accrue, and I’ll talk about “upwards stability” and what it means for the bringing on of world peace that Dorsey so hopes for, in the next section.

The Benefactors: Creating Upward StabilityThere is no thing that is bad for Bitcoin, and there is no thing that is not good for Bitcoin. But there are things that are especially good for Bitcoin — and they are “the benefactors.”

In an earlier piece, I referred to them as “The DCA Army,” and demonstrated that through their generosity, time and general attrition, Bitcoin could grow to $1 million per bitcoin well before the next halving. As I always say, “If you want the price to be stable, you’ve gotta put your nuts on the table!” and the benefactors I know are among the bravest, most selfless people in the world.

The Bitcoin benefactor is philosophically and economically aligned with the underlying ethos of Bitcoin. They believe that all people have the right of free expression and association, and the right to economic sovereignty and the fairness of a hard money standard — and that this system of economic and philosophical beliefs is what will make the world a better place.

The true believers believe that Bitcoin will grow regardless, forever, due to the nature of Bitcoin’s built-in incentive structure — and I totally agree — however, I do believe a relatively small committed group of benefactors could drive Bitcoin from being fickle to “upwardly stable,” and from tiny to huge in a few short easy years. This would hopefully avoid us all having to spend 30 grueling years in the figurative trenches, for Bitcoin to just inevitably win anyway.

People who want to save the trees put their money where their mouths are through various charities. Bitcoin benefactors increase the demand for bitcoin in hope of establishing a hard money standard, where more efficient and sustainable resource allocation will result in the saving of nature.

I’m not saying that donating to Greenpeace instead of buying bitcoin is a waste, but you’re probably making a far greater positive impact on nature simply by turning away from the proof-of-stake fiat system and increasing demand for bitcoin. The Harvard Global Philanthropy Report shows us what the world’s philanthropic priorities are in the figure below — typically education, health and human services. Outcomes in education, health and human services would be dramatically improved by simply providing sovereign economic infrastructure to the poorest of the poor, and providing them a fair, work-based economic playing field to put them on the path to building and securing wealth, no matter how small the amount.

The social and environmental justice warriors mean well, but the economic justice warriors deliver. It is literally as simple as increasing demand for bitcoin.

Figure six: World philanthropic prioritiesMost importantly, the beneficiary creates “upward stability.” The oxymoronic state of upward stability means that the price of bitcoin is either constant, or listing lazily upwards toward infinity at a steady rate (not necessarily slowly, just steadily) — never down.

For further clarification, the parabolic function of y = x2 can also be defined as “upwardly stable,” but the parabola I foresee for bitcoin is a little flatter. You see, for the merchant in El Zonte, a bitcoin that goes up and down like a yoyo, or even worse, drifts downward until the next 10x hype bubble in three years’ time, is not a useful economic platform to build on.

What is useful is something stable. What’s really useful is something that always goes up. Upward stability would obviously require stabilizing forces, as well as forces that drive upwards. As demonstrated in my hypothetical DCA scenario, the stabilizing force would be enough beneficiaries buying up and holding the entire daily issuance (and then some), every single day, eventually depleting the stores of many speculators over several years and guaranteeing a rock-solid floor price. The upwards force is any new marginal demand. If the new demand is a lump sum purchase, it will likely cause a temporary spike in price before a reversion to the floor. However, if the new demand comes in the form of a “recurring gift,” the floor is permanently lifted. Upward stability — a beautiful thing.

The Benefits And BeneficiariesTo be sure, bitcoin will never be “stable,” because it will go up forever. Volatility in both directions, however, will reduce dramatically with time, distribution and market size. But what would the benefits be if the benefactors’ goal of upward stability was achieved? Indeed, every human on the planet, even the ones who hate Bitcoin the most, are beneficiaries of this charitable movement.

When the price is upwardly stable, bitcoin “volunteers,” working for little pay or none at all, can dip into less and less of their savings over time. Instead of trying to find the best and most honest developers or projects to support and donate to, just create demand for bitcoin, and the best will rise to the top in time. You never know if a dev is malicious or incompetent — safer to just make “Number Go Up” and the good devs will become wealthier and not need your charity.

When the price is upwardly stable, no one will ever fear earning in and keeping their earnings in bitcoin, as most rightfully do now due to the nauseating volatility. This provides every person in the world with a robust, reliable, liquid, circular parallel economy and technology on which they can confidently build their futures. I struggle to think of anything more meaningful or charitable.

When the price is upwardly stable, bitcoin becomes a truly irresistible force; everybody will want it — whether it is by free choice and discovery, or the economic realities of life. It most certainly won’t be resisted at a political level due to risk of political and economic suicide. You can easily “resist” or legislate against something when nobody supports it — but if there are enough benefactors to create upward stability, bitcoin would be untouchable. The U.S. senate hearing in early August would have looked very different were bitcoin currently at $1 million per coin, and not down 50% from its recent highs. Few, however, remember that it increased 1,000% prior to the 50% drop.

Bitcoin can and will survive on its own merits, with or without an army of benefactors — but do we really have much more time to waste? Sure, charity is a fantastic thing, and you should continue doing charitable things in your life, especially when they cause tangible and immediate impacts on someone personally close to you — true peer-to-peer charity. But Greenpeace, et. al? Forget about it — the world is so much better off with everyone in the world opting out of the destructive proof-of-stake legacy system, building uncensorable and unseizable wealth, and bringing peace and prosperity to their homes, neighborhoods, towns, states and countries, and ultimately, the world.

Just increase demand for bitcoin, and teach and encourage others to do so, and the world will be a better place. This is literally playing life with cheat codes — enrich yourself, enrich the world. There is no greater act of charity that you will ever do in your life than commit to stacking sats. I am not trying to minimize the efforts of the tens of millions of people working in charity today, but basically, they would all have far more impact by simply converting a fixed portion of their salary to bitcoin than whatever it is they think they’re accomplishing for eight hours every day.

This is a guest post by Hass McCook. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.