Key Takeaways:

Custodia and Vantage Bank announce the first bank-issued stablecoin in the U.S., marking continued progress for regulated digital currency. Avit is an Ethereum-based stablecoin that provides a fully compliant and auditable way to tokenize U.S. dollar deposits inside — not outside — the banking system. This groundbreaking advancement opens new avenues in the intersection of blockchain technology and traditional finance, paving the way for seamless and transparent payments in the future.Custodia, in conjunction with Vantage Bank, recently introduced the first-ever U.S. bank-issued stablecoin— designated Avit — allowing it to operate across a permissionless blockchain. The launch, which was completed yesterday, marks the tokenization of U.S. dollar demand deposits on the Ethereum network, ushering in a new era for regulated digital currencies.

Introducing a New Era of U.S. Dollar Payments on BlockchainAvit’s successful launch establishes a new payment rail in the U.S. banking system, designed to meet the growing global demand for secure, compliant U.S. dollar stablecoins. This revolution in digital payments addresses inefficiencies in existing behind-the-scenes systems, replacing them with more transparent and technology-driven methods. By leveraging blockchain’s immutable ledger, Avit ensures greater accountability in transactions, reducing reliance on intermediaries and enhancing financial transparency. The deal was based on Custodia’s 2022 patent for dollar bank deposit tokenization on permissionless smart-contract platforms.

In a series of test transactions, all involved parties realized significant efficiencies, such as:

Lower transaction costs Faster settlement times Enhanced programmability Comprehensive auditabilityThese benefits are realized in a safe, compliant, and regulated banking system.

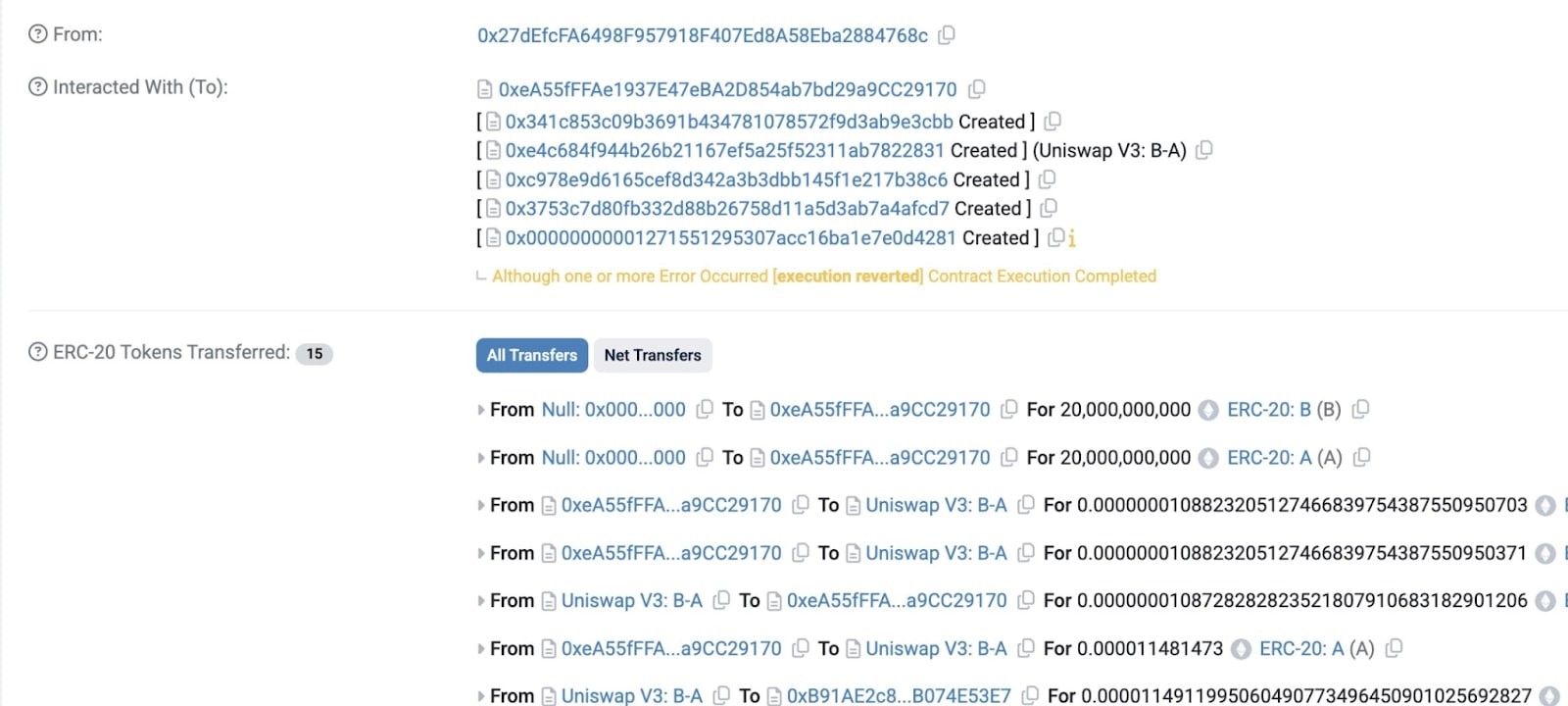

A Deeper Look into Avit Stablecoin FunctionalityThis collaboration enabled the minting, transfer, and redemption of Avit tokens for a bank customer on the Ethereum mainnet, based on the ERC-20 standard. This process involved eight complex stages. These processes were managed by Vantage Bank, which also provided Fedwire/ACH services for stablecoin fiat reserves. Custodia Bank, on the other hand, handled blockchain issuance/redemption, custody services, transaction monitoring, and reconciliation through its Avit Management System. This integrated system ensures that every transaction remains compliant with U.S. financial regulations while maintaining the efficiency benefits of blockchain-based payments.

BIG NEWS: @custodiabank & @Vantage_Bank have issued America’s first bank-issued #stablecoin on a permissionless blockchain. First-ever tokenization of a U.S. bank’s U.S. dollar demand deposits for a bank customer on a permissionless blockchain:https://t.co/6hrBGGEouA pic.twitter.com/wnAKfvKU35

— Custodia Bank (@custodiabank) March 25, 2025

A business customer transferred Avit tokens into self-custody, used them for B2B transactions outside traditional banking, then redeemed them at Custodia Bank for U.S. dollar deposits. This is in stark contrast to the majority of stablecoins, which tend to exist outside the traditional banking framework. The Avit pilot was restricted entirely to a controlled banking setting.

How Avit Makes Your U.S. Banking Compliance Steps EffortlessA key component of this endeavor was full compliance with all relevant U.S. bank regulatory requirements, including BSA/AML/OFAC. This necessitated both banks to craft specialized documentation, policies and procedures that diverge from what is currently utilized by existing stablecoin issuers. Both banks collaborated closely with their regulators to make this groundbreaking project a success.

Caitlin Long, CEO of Custodia Bank, highlighted a bright spot on the regulatory front. Custodia Bank demonstrated that U.S. banks could collaborate to tokenize demand deposits on a permissionless blockchain in a fully compliant manner, she said. Long was optimistic that easing regulatory hurdles will let U.S. consumers benefit from blockchain’s scalability. She emphasized that the real impact is on TradFi, highlighting Custodia Bank’s breakthrough with Vantage Bank. This collaboration sets a precedent for other financial institutions looking to explore blockchain integration without compromising regulatory compliance.

Jeff Sinnott, President and CEO of Vantage Bank, emphasized that this marks a turning point in financial services, showcasing the power of blockchain and stablecoins in payments. Through this transaction, he noted, they are empowering banks to start responsibly leading the way in cross-border modernization, while scaling the strength of the U.S. Dollar and showing regulators’ support for responsible innovation.

Avit and the Future of Stablecoins: U.S. Dollar’s Next ChapterThis is important because it shows that banks in the U.S. can issue tokenized deposits on public networks in a compliant manner. This will help lay the groundwork for a future real-time, programmable payments infrastructure that is grounded in the regulatory rigor of U.S. banking law.

Federal Reserve Governor Christopher Waller, as recently as March, claimed that U.S. dollar-pegged digital assets are a means to increase dollar supremacy in the world. Stablecoins already play an important role in their own financial ecosystem. They provide a stable store of value for crypto traders, access to digital dollars in high-inflation economies, and enable online cross-border payments with lower fees. Right now, we are also seeing early but promising use cases in retail transactions, he said. As U.S. policymakers debate stablecoins, Avit’s launch may model dollar digitalization, showcasing blockchain’s potential to modernize banking.

More News: Bipartisan ‘Congressional Crypto Caucus’ Formed in US Congress

The post First U.S. Bank Issues Stablecoin on a Permissionless Blockchain appeared first on CryptoNinjas.