Key Takeaways:

RWA tokens have made a remarkable recovery, with their total market cap nearing its all-time high of $17.1 billion. RWA tokens are beating the rest of the digital assets while the market is retracting, signaling that investor optimism is coming back. Institutional investors are increasingly favoring RWAs, while retail participation remains limited.The cryptocurrency sector, which is no stranger to volatility, is looking stronger again due to a rather unexpected sector that is at the forefront—Real-World Asset (RWA) tokenization. As of early February 2025, the total value locked (TVL) in RWA tokenization markets has surged back to an all-time high of $17.1 billion, the same level as in mid-January.

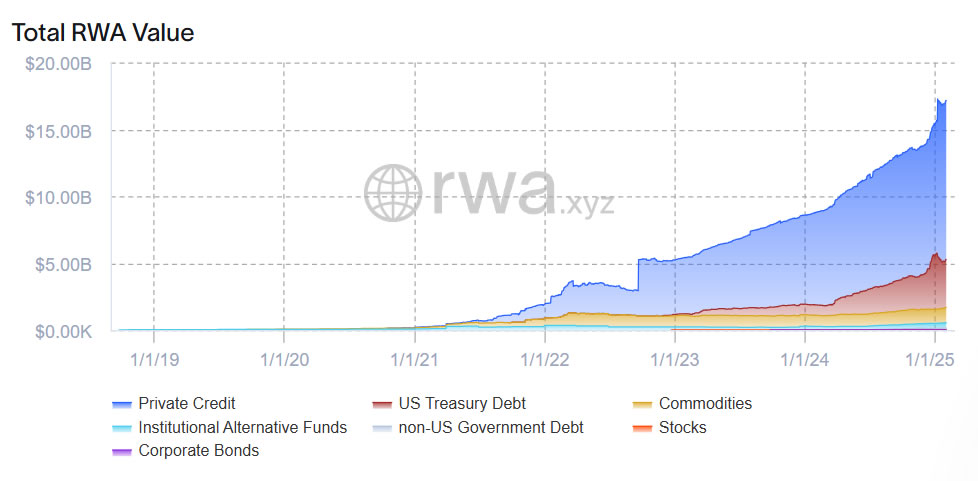

RWA total value on-chain. Source: rwa.xyz

This is even more impressive since the rebound is coming alongside Bitcoin, the leading light of the digital coins market, which is struggling to sustain its position above the much-desired $100,000 level. This, in turn, raises the question: Are RWAs the future of finance, making a way for a connection between traditional securities and the blockchain-based decentralized system?

RWA Tokens Surge as Broader Crypto Market RecoversThe crypto rebound has been divergent until now as some altcoins have been laggards whereas Bitcoin has been trying to regain ground. However, in the domain of RWA-based virtual money, things look different. The announcement of U.S. President Donald Trump’s halt on tariffs towards both Canada and Mexico appeared to bring new hope, and RWA coins were among the first ones to surge in response.

Here are some notable price movements:

Link (LINK): Chainlink (LINK), a leading blockchain oracle provider, saw its token price surge 22% to a record high of over $21, recovering from a previous low of $17. OM (OM): As a possibility, the RWA-layer-1 technology had a surge by 23% and gained back the $6 level. DeFi of Ondo Finance (ONDO): With a previous crash of the DeFi platform to a level below $1.10, the platform set a new record of rising almost 27% reaching $1.40 and climbing rapidly. Chintai (CHEX): It was registered by MAS-Monetary Authority of Singapore, one tokenization platform which had 38% appreciation of its native token up to $0.60 having plunged beneath $0.40 earlier on.All other RWA-oriented crypto assets like Algorand (ALGO), XDC Network (XDC), Quant (QNT), and Pendle (PENDLE) are doing better than the rest of the market. This performance difference can be seen as the growing demand for assets which have both traditional financial stability and growing blockchain innovation.

Australia-based cryptocurrency platform Swyftx lead analyst Pav Hundal had a fascinating viewpoint: “Nothing about the market is normal right now, including this rebound,” Hundal shared, “Tokenization has been a bit of a market wallflower recently for reasons that are not easily explicable. But we are talking about projects that create real solutions to support markets like bonds and equities.”

The RWA tokenization process on a blockchain is the representation of financial and tangible assets. These assets can be something that is as rare as commodities like gold and silver or that is as common as real estate, bonds, equities, and private credit. The overall goal is to find ways to make bond trading more efficient and enable investors to have more chances to invest in real assets which are usually not that liquid.

The Rise of RWA Tokenization: A $30 Trillion Opportunity?The TVL of the RWA tokenization market on-chain has shown an upward trend from the beginning of November 2024, which coincided with a wider rally in the crypto market. Since that time, it has increased by almost 26% and $3.7 billion have been included in total. It is not the result of a lucky break; it is the indication of a monumental metamorphosis in the way assets are accepted and traded.

According to RWZ.xyz, nearly 70% of tokenized capital is allocated to private credit, followed by U.S. Treasury debt at 21%.

RWA value chart. Source: RWA.xyz

The financial landscape is evolving, moving away from traditional practices. As Haqq Network co-founder Andrey Kuznetsov claimed on February 1st, the transformation of asset tokenization is “fundamentally changing financial markets,” and “Wall Street titans are sensing the signs and preparing to lead this change“. This could be a billion-dollar market, making some predictions of a possible RWA tokenization market with a record-breaking size of $30 trillion. For example, BlackRock CEO Larry Fink has been among the most candid champions of regulatory clarity on tokenized securities, where he has expressed the idea that digital assets will be commoditized on blockchain networks in the future.

The general lawyer of the Centrifuge RWA tokenization platform, Eli Cohen, thinks that extra government stimulus for the market will be the consequence of the Trump administration giving up the conservative approach.

Institutional Interest vs. Retail ReluctanceAlthough the highly valued RWA market may look like everything is going smoothly, a focus on the dynamics of investor behavior might give us a different picture. The on-chain information unveils the fact that the participants from the institutional sector are significantly taking into account RWA tokens, while the retail trading is, in contrast, sharply declining. Notably, this move can be seen as a possible transition to a new market model.

Why do financial institutions opt for RWAs?

Diversification: RWAs are a way to variance a portfolio beyond traditional cryptos, which may lengthen overall portfolio risk. Stable Yield: Tokenization of assets such as private credit or US Treasury debt could be a safe and stable way to yield compared to volatile crypto assets. Hedge Against Uncertainty: RWAs can be a measure of safe haven for the capital in the market turmoil situation, simulating a hedge with an underlying economic context that stands uncertainty, thus, becoming the one and only safe destination.Vlad Tenev, CEO of Robinhood, has been advocating for rules that would allow retail investors to have wider access to tokenized private equities, which is now a market primarily for the rich.

This uptrend of institutional interest acts as a confirmation of RWAs gaining credibility in the financial world.

A Concrete Example: A small business owner from Argentina finds it hard to get standard financing due to political instability and currency devaluation. By digitizing their real-life assets, such as accounts receivable, they can access the global fund of money through cutting off local restrictions and by that, they can also attract investors who would get a higher return. Centrifuge and a few other similar platforms are actively involved in this area, therefore, they are the ones that are symbolizing the real impact of RWA tokenization.

More News: Bitwise Predictions for 2025: The Golden Era of Cryptocurrency

Challenges and the Road AheadEven though the future looks bright for RWAs, the market has not come without its difficulties. Issues of regulatory uncertainty, interoperability among different blockchains, and the need for stronger security measures are the main hurdles.

To support the growth of the RWA market, several key steps must be taken.

Develop regulatory policies: It is the job of both governments and regulatory bodies to provide clear guidelines for the issuance and trading of RWAs that are tokenized and in this way they will be able to foster trust and bring about clarity. Standardization and Interoperability: For both standardized protocol for RWA tokenization and making it compatible between various blockchain networks both of these tasks are very important so that asset transfer and market liquidity can be done in an ideal seamless way. Enhanced Security Measures: Protecting tokenized assets from fraud and cyberattacks is a top priority. Besides smart contract audits and secure custody solutions, robust and strong security measures play a significant role in maintaining investor confidence.Nevertheless, the RWA tokenization market is on course to its growth. As traditional financial institutions integrate blockchain technology and regulatory environments get less cloudy, RWAs are bound to become the dominant form of issuing, trading, and accessing valuable properties worldwide. The recent surge in RWA tokens is a promising sign that this change is already happening.

The post Real-World Asset (RWA) Tokens Lead Crypto Recovery: Are They the Future of Finance? appeared first on CryptoNinjas.