After a sharp rally that outpaced even Bitcoin and Ethereum in percentage gains, $SOL is now facing renewed pressure. The broader crypto market slowdown, combined with Solana’s own $200M unlock event, has introduced fresh volatility and raised questions about its short-term direction.

With momentum cooling and technicals flashing mixed signals, the next Solana price prediction hinges on whether key support levels around $110 can hold. A bounce from here could revive bullish sentiment, potentially targeting the $130–$170 range. But if sellers keep control, a drop below $100 could be back on the table.

Solana Price Skyrockets, Then Tumbles—How Does It Compare to Bitcoin and Ethereum?Solana has stood out in the crypto market, showing impressive growth alongside Bitcoin and Ethereum. According to Bloomberg data, Solana has led to one of the highest price appreciations in high caps, demonstrating strong investor confidence and growing adoption.

Solana price compared with Bitcoin and Ethereum performance since 2023. Source: The Crypto Professor via X

Crypto analyst The Crypto Professor highlights that Solana price moves in well-defined cycles, experiencing phases where both price and on-chain activity peak before resetting. While Bitcoin and Ethereum have already reached a more stable growth phase, Solana is gradually following suit. As the broader market evolves, Solana’s ability to sustain its upside while maintaining cyclical health could solidify its role as a long-term contender in the crypto space.

$200M Solana Unlock: A Market Stress Test?Solana’s largest single-day unlock until 2028 is set to hit the market, releasing $200 million worth of SOL. This event comes at a time when the broader crypto market is struggling, with Solana facing increased volatility near key support levels. Historically, large unlocks have introduced short-term selling pressure, especially in weak market conditions. If a significant portion of this unlocked SOL is sold rather than restaked, it could weigh on Solana’s price, making this a crucial moment for traders and investors.

Solana’s $200M unlock event sparks concerns over potential market volatility. Source: Arkham via X

According to on-chain platform Arkham, four accounts that staked SOL in April 2021 will be unlocking a combined $201.9 million worth of SOL. With such a large supply becoming liquid, market participants are closely watching to see whether this unlock triggers increased sell pressure or if strong demand absorbs the new supply.

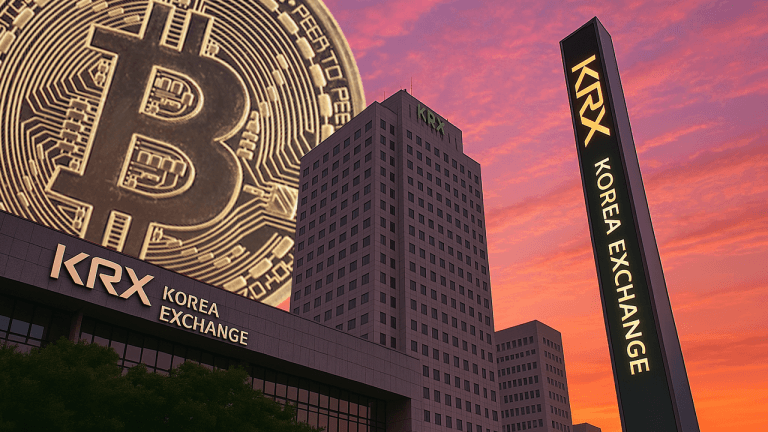

Ethereum Overtakes Solana in DEX VolumeWhile Solana price faces market uncertainty due to its $200M unlock, Ethereum has reclaimed the DEX dominance crown for the first time since September. According to Kronos Research, Ethereum accounted for 26.3% of the total DEX volume in March, surpassing Solana’s 21.4% share. The total decentralized exchange volume reached $245.8 billion, signaling a competitive shift in the DeFi landscape.

Solana loses DEX volume dominance to Ethereum, dropping to a 21.4% market share in March. Source: Kronos Research via X

For months, Ethereum and Solana have been pushing each other to lead in DEX activity, with both chains seeing massive adoption. Solana’s rapid transaction speeds and low fees gave it an edge in recent months, but Ethereum’s deep liquidity and extensive ecosystem have kept it in the race. This back-and-forth competition continues to fuel innovation in both chains.

Solana’s Distribution Accelerates: A Pivotal MomentSolana’s price action is flashing warning signs as analyst Sri_Phoenix highlights a clear distribution phase unfolding. Selling pressure has been immense, with each bounce now getting weaker and resistance levels holding firm. This steady change of hands, combined with Solana’s $200M unlock event, is creating a tense market environment.

Solana’s distribution phase accelerates as selling pressure rises as price moves into Phase D and E. Source: Sri_Phoenix via X

The chart suggests that Solana’s price appears to be in Phase D of the distribution cycle, where the market struggles to push higher and liquidity starts drying up. The next phase would be E, where a breakdown can occur if buyers fail to reclaim key levels. If Solana fails to show strength, a move lower could confirm the final leg of this distribution phase.

Solana Price Prediction: Trading Tank Spots Key Reversal SignsAfter weeks of heavy selling, crypto analyst Trading Tank is spotting early signs of a potential bottom for $SOL, with key support holding firm around the $119-$110 zone. This level has acted as a strong demand area, and with price showing multiple wicks into this range, buyers seem to be stepping in. The chart also highlights bullish divergence, suggesting that momentum is shifting despite the price still hovering near the lows. If Solana maintains this base, we could see a structured recovery play out.

Analyst spots bullish divergence in Solana as $SOL defends key support zone, hinting at a potential reversal. Source: Trading Tank via X

For this Solana price prediction, the upside roadmap shows potential resistance at $129-$143, followed by a more significant test around $167-$171, where trendline resistance aligns. A clean breakout above this zone could open the door for a move toward $180+, but for now, bulls need to confirm strength by holding above the current support. While the downtrend isn’t officially broken yet, Trading Tank’s analysis suggests the worst might be over if bulls can follow through.

Where Does Solana Go from Here?Solana’s next big move depends on whether buyers can step up or if sellers keep the pressure on. Right now, the $119-$110 support zone is the main area, and if it holds, the price could see a bounce toward $129-$143 and maybe even $167-$171 if momentum picks up. But if that level breaks, things could get rough, possibly dragging SOL Solana price below $100.

The $200M unlock is a concern, and with Ethereum reclaiming DEX dominance, Solana has some catching up to do. It’s a waiting game now to see if buyers take control and push prices back up or if the market stays under pressure.