As the United States gears up for another significant presidential election, the intersection of politics and cryptocurrency has emerged as a critical area of focus. The candidates, former President Donald Trump and Vice President Kamala Harris, offer contrasting visions for the future of digital currencies and blockchain technology. This divergence is not only shaping the political landscape but also influencing financial markets, particularly the rapidly growing cryptocurrency sector.

The Crypto Landscape Amidst Political Uncertainty

Cryptocurrency, once a niche interest, has evolved into a major financial force. Its decentralised nature and potential for high returns have attracted a wide range of investors, from tech-savvy millennials to institutional giants. However, the regulatory environment remains uncertain, with policymakers grappling with how to integrate these digital assets into the existing financial system.

In this context, the upcoming U.S. presidential election could be a turning point. The candidates' differing approaches to cryptocurrency regulation and adoption could have profound implications for the industry. As such, the election is not just a political contest but a referendum on the future of digital finance.

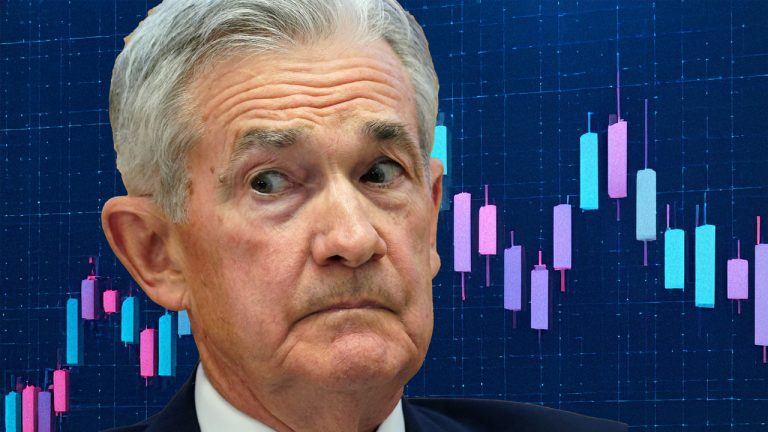

Wall Street's Bet on Trump

Wall Street's apparent preference for a Trump victory is rooted in his administration's historical approach to regulation and taxation. Trump's presidency was marked by a deregulatory agenda, which many investors believe could benefit the cryptocurrency industry. Lower taxes and fewer regulations could create a more favourable environment for crypto businesses, potentially spurring innovation and growth.

This sentiment is reflected in the behaviour of prediction markets, where Trump's odds of winning have surged. Platforms like Polymarket and PredictIt have seen significant bets placed on a Trump victory, with some investors wagering millions of dollars. These markets, which allow users to bet on the outcome of events using cryptocurrency, have become a barometer of investor sentiment.

One week until the election.🟥 Trump • 66% chance🟦 Harris • 34% chanceGet accurate, real-time election odds on the world's largest prediction market #Polymarket

— Polymarket (@Polymarket) October 29, 2024The enthusiasm for Trump among crypto investors is not surprising. During his previous term, Trump expressed scepticism about cryptocurrencies but refrained from implementing harsh regulations. His administration's focus on economic growth and deregulation aligns with the interests of many in the crypto community, who view excessive regulation as a barrier to innovation.

Harris and the Promise of Innovation

In contrast, Vice President Kamala Harris represents a more cautious approach to cryptocurrency. While she has not been as vocal about her stance on digital currencies, her campaign has emphasised the importance of innovation and technology. Harris has promised to encourage the development of emerging technologies, including artificial intelligence and digital assets, while ensuring consumer protection and financial stability.

Harris's approach reflects a broader Democratic strategy of balancing innovation with regulation. Her administration would likely prioritise consumer protection and financial stability, potentially leading to stricter regulations on cryptocurrencies. This could include measures to prevent fraud, protect investors, and ensure the stability of the financial system.

Despite these potential challenges, Harris's focus on innovation could also benefit the crypto industry. By fostering a supportive environment for technological development, her administration could encourage the growth of blockchain technology and digital assets. This could lead to new opportunities for entrepreneurs and investors, even if it means navigating a more complex regulatory landscape.

The Role of Prediction Markets

The divergence between traditional polls and prediction markets highlights the unique dynamics of this election. While many polls show a close race between Trump and Harris, prediction markets have consistently favoured Trump. This discrepancy can be attributed to several factors, including the influence of large investors, or "whales," who have placed substantial bets on a Trump victory.

These markets, which operate on blockchain technology, offer a decentralized platform for betting on the outcome of events. They have gained popularity in recent years, particularly among crypto enthusiasts who appreciate their transparency and accessibility. However, their predictions should be interpreted with caution, as they reflect the views of a specific subset of investors rather than the broader electorate.

The influence of prediction markets on media coverage is also noteworthy. As these platforms have gained prominence, their odds have been cited as evidence of Trump's growing lead. This has contributed to a narrative that may not fully align with traditional polling data, underscoring the complex relationship between media, markets, and public perception.

Latest Swing State Odds 🟥 Arizona • Trump 74% - Harris 26%🟥 Georgia • Trump 73% - Harris 27%🟥 Wisconsin • Trump 59% - Harris 41%🟥 Michigan • Trump 53% - Harris 47%🟥 Nevada • Trump 66% - Harris 34%🟥 Pennsylvania • Trump 62% - Harris 38% pic.twitter.com/8CdT68AfRx

— Polymarket (@Polymarket) October 29, 2024The Future of Cryptocurrency Regulation

The outcome of the election will have significant implications for the future of cryptocurrency regulation in the United States. A Trump victory could lead to a continuation of the deregulatory approach that characterised his previous administration. This could create a more favourable environment for crypto businesses, potentially attracting investment and fostering innovation.

On the other hand, a Harris administration would likely prioritise consumer protection and financial stability, potentially leading to stricter regulations. While this could pose challenges for the industry, it could also provide a more stable and secure environment for investors, ultimately benefiting the market's long-term growth.

Regardless of the outcome, the election will serve as a critical juncture for the cryptocurrency industry. As digital currencies continue to gain traction, policymakers will need to strike a balance between fostering innovation and ensuring the stability and security of the financial system. This will require collaboration between regulators, industry leaders, and other stakeholders to develop a regulatory framework that supports the growth of digital finance while protecting consumers and maintaining financial stability.

Fire Gary GenslerProvide fair regulations that promote innovation and equality through decentralization Provide disclosures Give the same freedom to retail as accredited investors get pic.twitter.com/eHbWcBzmq1

— Wendy O (@CryptoWendyO) October 24, 2024Conclusion: A Pivotal Moment for Crypto

The U.S. presidential election is a pivotal moment for the cryptocurrency industry. The candidates' differing approaches to regulation and innovation will shape the future of digital finance, influencing everything from market dynamics to investor sentiment. As such, the election is not just a political contest but a referendum on the future of cryptocurrency.

For investors and industry leaders, the stakes are high. A Trump victory could lead to a continuation of the deregulatory approach that has benefited the industry, while a Harris administration could introduce new challenges and opportunities. Regardless of the outcome, the election will serve as a critical juncture for the cryptocurrency industry, shaping its trajectory for years to come.

As the election approaches, the crypto community will be watching closely, eager to see how the outcome will impact the future of digital finance. Whether through deregulation or innovation, the next administration will play a crucial role in shaping the future of cryptocurrency, influencing everything from market dynamics to investor sentiment. In this context, the election is not just a political contest but a referendum on the future of digital finance.

This article was written by Anndy Lian at www.financemagnates.com.