XRP is trading at $3.11, reflecting a slight 2% dip in the past 24 hours. However, the overall market sentiment remains optimistic, fueled by promising technical setups, a new ad campaign, and rising adoption metrics,

Resistance and Support Zones to WatchXRP’s price is consolidating below the $3.30 resistance level, signaling a buildup of buying pressure. A recent pullback of around 7% is minor when compared to the previous 45% rally, underscoring the cryptocurrency’s volatility. Key support levels between $2.52 and $2.94 provide a safety net for traders, enabling potential re-entry points in case of further dips.

Key levels to watch for XRP. Source: TradingView

Market strategist Bobby A suggests that “as long as XRP holds above the $2.32-$2.33 range, the bullish momentum is likely to persist.” Technical analysis indicates that a triangle pattern may be forming, a setup often associated with price consolidation before a significant upward movement.

Indicators of Growth: Adoption and On-Chain MetricsBeyond price action, XRP’s adoption metrics are showcasing robust growth. According to data published earlier, payment volume between XRP accounts topped 1.5 billion, reflecting fresh demand for the digital asset. The number of active XRP accounts, meanwhile, has cleared 50,000 for the first time this month, demonstrating “explosive growth in the network’s user base.”.

XRP spot inflow and outflow chart. Source: CoinGlass

These metrics, put together with the ability of XRP to process large sums of transactions, are indicative of a maturing ecosystem. “The growing demand for XRP reflects increasing trust in its ecosystem and its broader use cases,” noted market observer Jason Jones. “We think XRP will go to the moon,” he said.

Potential for Significant GainsLooking ahead, XRP’s next key price targets are set at $4.20 and $5. A breakthrough at these levels could pave the way for an eventual climb to $6.61, according to technical projections. Historical trends offer additional perspective; during the 2017 bull run, XRP experienced a staggering 1,330% surge, a growth trajectory some analysts believe could be replicated under the right market conditions. This would see XRP flip Ethereum, which would be amusing indeed.

Despite the potential for a possible pullback, the XRP price remains steady above the $3 mark. Source:XRP Liquid Index (XRPLX) via Brave New Coin

For context, an investment of 20,000 XRP three months ago, priced at $0.3522 per token, would now be worth $65,540—a stark contrast to the original $7,084 outlay. Such returns underscore the transformative potential of XRP for long-term investors.

Catalysts Driving the Bullish NarrativeSeveral factors underpin XRP’s bullish outlook. In this respect, Ripple Labs is incessantly innovating within its ecosystem. It recently introduced the RLUSD stablecoin, pegged to the U.S. dollar, as a means to bring additional liquidity and indirectly increase XRP’s market activity. Meanwhile, enhancements in the XRP Ledger are constantly adding functionality to it.

RLUSD Treasury issues 2,008,333 units in 24 hours, highlighting its rapid growth. Source: XRP via X

Adding to the mystery of its market position is the speculated XRP ETF product and XRP’s inclusion in a U.S.-backed altcoin reserve with Solana. Both could attract institutional investors to the asset class and, therefore, strengthen its value proposition.

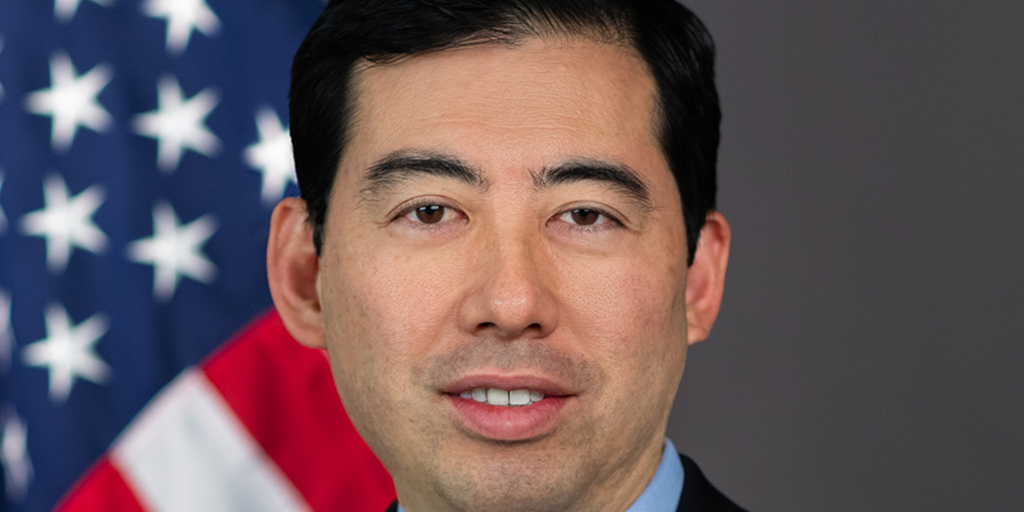

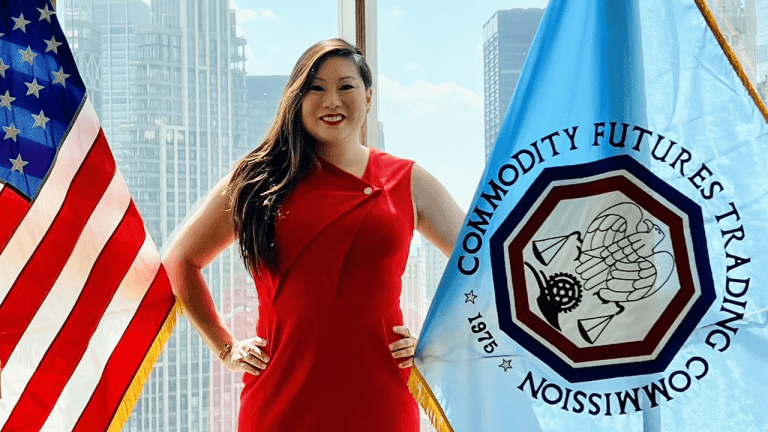

Adding credibility to this theory, Ripple XRP billboards have begun to appear in the US, stating that Ripple and XRP represent American leadership in Crypto.

Ripple and XRP represent American leadership in Crypto. Source: X

Cautious Optimism for XRP’s FutureWhile short-term fluctuations are inevitable in the volatile cryptocurrency market, XRP’s strong support levels and promising technical patterns indicate a bullish outlook. Traders should monitor the $3.30 resistance level closely, as breaking through could trigger heightened buying activity.

With long-term targets set as high as $6.61, XRP remains a compelling asset for investors seeking exposure to a high-potential digital currency. However, as always, market participants are advised to exercise caution and remain vigilant in light of the inherent risks of cryptocurrency trading.