This wide-ranging valuation, conducted by Valhil Capital’s Jimmy Vallee and Molly Elmore, highlights the potential of Ripple’s native cryptocurrency as a major player in global value transfer.

Source: Molly Elmore

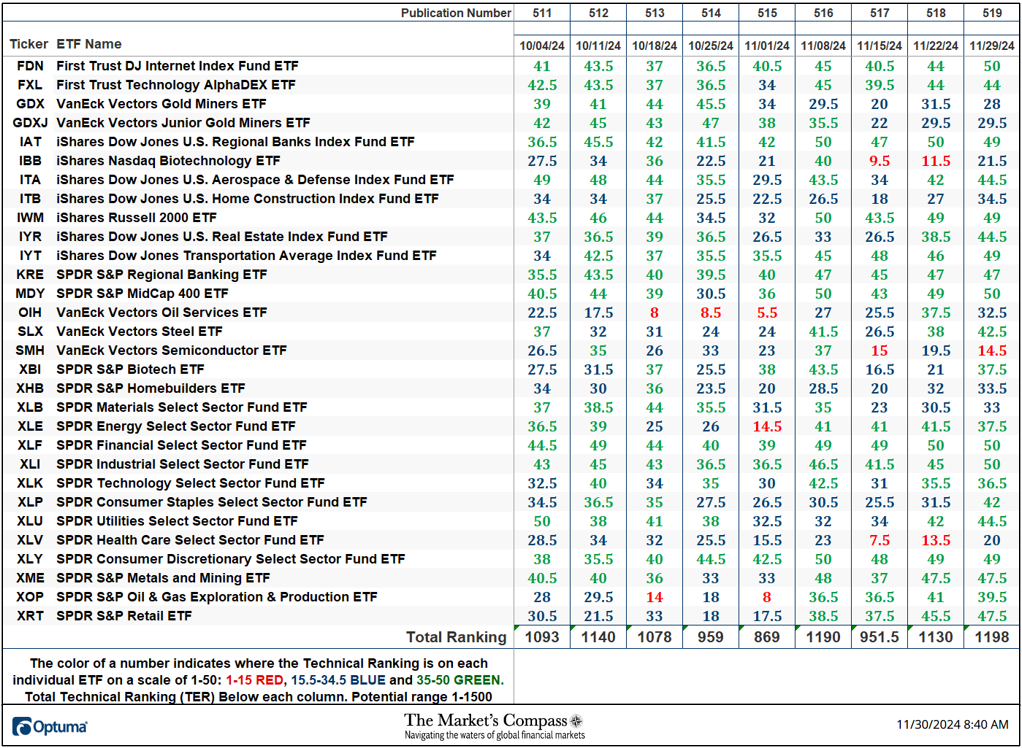

The study utilizes six distinct valuation models to assess XRP’s worth, each offering a unique perspective on its utility as a layer-1 asset. According to the findings, XRP could reach as high as $22,000 under optimistic scenarios, with some models even suggesting values of $122,000 and $513,000. These projections depend heavily on the assumption that the XRP Ledger becomes a widely adopted protocol for international transactions.

Source: Molly Elmore

XRP’s Valuation Amid Pro-Crypto Policy ShiftsVallee and Elmore’s report delves into various methodologies to estimate XRP’s market value. For example, the Athey & Mitchnick Models evaluate XRP based on different global liquidity scenarios. Under a $1 quadrillion scenario, XRP could be valued at $9,000, while a $530 trillion scenario suggests a price of $4,800. Another model, the Bakkes Pipeline Flow, focuses on XRP’s role in facilitating global transactions, estimating its value at $3,500.

In addition to these, the study explores collateralization models, where XRP’s value reaches $12,200 with 100% collateralization and $1,220 with 10% collateralization. Discounted Cash Flow (DCF) models further refine these estimates, projecting XRP’s value to rise to $21,900 with a 3% discount rate. These varied approaches underscore the multifaceted potential of XRP in different financial contexts.

The timing of this study coincides with significant political shifts in the United States. Following Donald Trump’s victory in the presidential election, major crypto companies like Ripple and Coinbase anticipate a more favorable regulatory environment. Trump has signaled a pro-crypto stance and intends to replace SEC Chair Gary Gensler, which could lead to a reevaluation of ongoing cases against these firms.

Paul Grewal, Coinbase’s Chief Legal Officer, expressed optimism about potential regulatory changes. In an interview, he stated:

“I think the new administration will take a fresh look at all the existing crypto cases brought under Gary Gensler and distinguish between the ones aimed at what are clearly scams and fraud and ones that are not.”

The study’s median XRP value stands at approximately $12,822, with a mean value of $61,231, reflecting the optimistic outlook among analysts. The highest Quantum Liquidity Model in the study suggests XRP could reach $513,000 if its store-of-value utility is maximized. While these figures are ambitious, they highlight the potential upside if XRP gains widespread adoption.

Pro-Crypto Stance Fuels XRP’s FateCoinbase CEO Brian Armstrong also considered the election “a huge win for crypto.” He noted that the support for crypto was a decisive factor in Bernie Moreno’s victory over Senator Sherrod Brown in Ohio, indicating a broader congressional shift towards a pro-crypto stance. This political backing could be crucial in driving XRP’s adoption and, consequently, its market value.

The evolving regulatory landscape is a critical factor influencing XRP’s future. With the possibility of a crypto-friendly SEC leadership, the industry expects clearer rules and fewer enforcement actions. Grewal emphasized the need for the SEC to engage with the crypto community, stating:

“Stop suing crypto. Start talking to crypto. Initiate rulemaking now. There’s no reason to wait.”

Ripple’s leadership has also provided a 100-day checklist for the new administration, urging swift action to improve the SEC’s approach to cryptocurrency regulation. By advocating for experienced figures like Chris Giancarlo, Brian Brooks, or Dan Gallagher, Ripple aims to foster a more supportive environment for XRP and the broader crypto market.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article