This staggering figure has become a focal point of the ongoing criminal case against Kwon, shedding light on the extensive impact of the Terra collapse and the resulting financial devastation.

Acting U.S. Attorney Daniel Gitner, speaking at a recent court session in New York, highlighted the immense challenge of quantifying those affected. “While it is difficult to precisely quantify the number of Kwon’s victims in light of the sheer number of purchases and sales of Terraform’s cryptocurrencies and the manner of those transactions, … the Government estimates that the number of victims, in this case, exceeds hundreds of thousands of individuals and entities, and potentially totals more than one million,” Gitner stated in court filings.

The Victim CountThe colossal victim count underscores the sweeping nature of the alleged fraud. Prosecutors claim that Kwon’s Terra ecosystem misled investors by promising a decentralized financial network featuring advanced technologies such as its own currency, payment system, and even a stock market-like platform. By falsely asserting the autonomy of the Terra system—concealing the centralized control exercised by Kwon and his team—investors were deceived into believing they were participating in a secure and innovative investment venture.

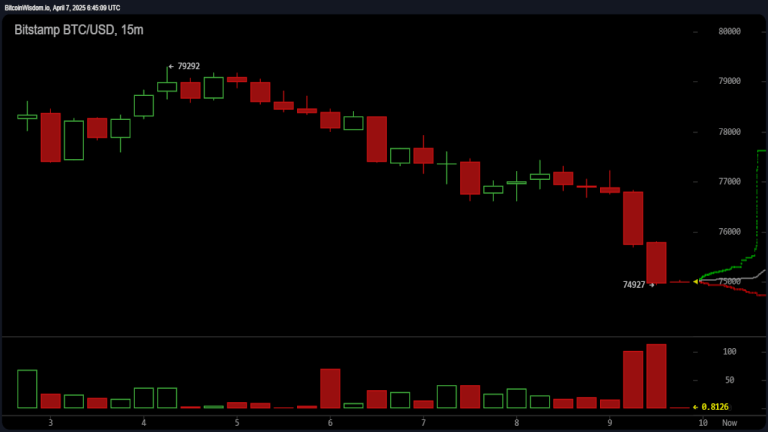

The collapse of the algorithmic stablecoin TerraUSD (UST) and its sister cryptocurrency Luna in May 2022 led to catastrophic financial losses estimated at over $40 billion. The fallout from this collapse affected not only individual investors but also large institutional entities, plunging them into uncertainty and financial hardship. “Ultimately, investors suffered over $40 billion in losses as a result of Kwon’s fraud,” the court documents allege, painting a grim picture of the far-reaching consequences of the Terra debacle.

As the legal proceedings continue, prosecutors are taking steps to address the logistical difficulties posed by notifying a potential victim pool that could number over one million. Given the impracticality of direct notification to each affected party, the U.S. government proposed creating a public website to disseminate information about case updates and inform victims of their rights under the Justice for All Act of 2004. This initiative is part of a broader effort to ensure that victims can access updates on court dates, filing procedures, and potential restitution processes.

Legal experts note that the Do Kwon case could set a significant precedent for how large-scale cryptocurrency fraud is addressed. The sheer scale of potential victims highlights the urgent need for improved regulatory frameworks within the crypto industry. According to recent statements by financial and legal analysts, the collapse has shaken investor confidence and emphasized the necessity for tighter oversight, transparency, and investor protection measures in the cryptocurrency sector.

Meanwhile, Do Kwon, now 33, faces multiple criminal charges in the United States, including securities fraud, wire fraud, commodities fraud, conspiracy to commit money laundering, and others. After being extradited from Montenegro in December 2024, Kwon pleaded not guilty to the charges during his first court appearance on January 2, 2025. If convicted on all counts, he could face up to 130 years in prison.