Despite the expected rate cut adjustment, Powell’s indication that the Fed would adopt a cautious approach to further rate cuts in 2025 appears to have rattled investors, pushing them away from high-risk assets like cryptocurrencies and U.S. equities.

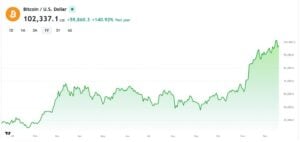

Bitcoin Hits $100,430 After Record HighBitcoin, the largest cryptocurrency by market cap, experienced a sharp 5% drop in the past 24 hours, falling to $100,430 after briefly hitting a new all-time high of $108,000 earlier in the week. The downturn came amid broader market unease following Powell’s comments, erasing gains from three consecutive days of record-breaking highs.

Source: BNC Bitcoin Liquid Index

XRP took an even steeper dive, losing 10% on the day after its brief Tuesday spike. Similarly, Dogecoin plummeted 9%, dropping to $0.363—a monthly low for the top meme coin.

Source: BNC XRPLX

Crypto Liquidations Surge Amid Market TurmoilThe rate decision triggered a cascade of liquidations as traders with bullish positions were caught off guard. In the past 24 hours, over $690 million in futures positions were liquidated, with the majority being long bets. A staggering $300 million in liquidations occurred within just one hour, according to data from CoinGlass.

Fed’s Rate Policy Shifts Narrative for CryptosCryptocurrencies like Bitcoin have historically thrived in low-interest-rate environments, much like equities, due to the increased appetite for risk and liquidity. However, the Federal Reserve’s aggressive rate hikes in 2022, aimed at combating post-pandemic inflation, dampened the appeal of Bitcoin and similar assets.

This week’s moderate 25-basis-point rate cut suggests a shift in strategy, but Powell’s statement—“We can therefore be more cautious as we consider further adjustments to our policy rate”—left markets on edge, fueling uncertainty about the pace of future monetary easing.

Despite Wednesday’s slump, Bitcoin’s recent rally to an all-time high of $108,000 underscores its growing role in financial markets. Notably, some prominent figures, including former President Donald Trump and other Republicans, have floated the idea of the U.S. holding Bitcoin in its strategic reserves—a move that, while speculative, signals the cryptocurrency’s increasing legitimacy.

Powell: Bitcoin Is Gold’s Rival, Not the Dollar’sEarlier this year at the New York Times DealBook Summit, Powell reiterated that Bitcoin is more comparable to gold than to the U.S. dollar, highlighting its role as a speculative asset rather than a reliable store of value. “Bitcoin is not a competitor for the dollar; it’s really a competitor for gold,” Powell said. However, he dismissed the notion of the Federal Reserve holding Bitcoin, stating, “The Federal Reserve is not allowed to own Bitcoin, nor are we looking for a law change.”

The volatility following Powell’s remarks underscores the delicate balance central banks must strike in managing monetary policy without unsettling financial markets. As Bitcoin continues to carve out its niche, comparisons to gold reflect its growing stature, but its highly speculative nature keeps it tethered to market sentiment and macroeconomic shifts. For now, the crypto market remains at the mercy of cautious monetary policy, with its next moves likely tied to the Fed’s broader strategy in 2025