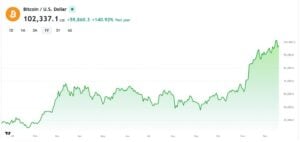

With current market momentum suggesting a longer climb up in 2025, many are wondering if this rally could surpass all previous records.

Source: Blockchain Center

Since November, Bitcoin’s growth has showcased clear signs of maturation. Sovereign wealth funds and pension plans have noticeably increased their exposure, marking a shift toward mainstream legitimacy. For example, BlackRock’s iShares IBIT Bitcoin ETF saw over $17 billion in inflows, underlining the growing appetite among institutional investors.

This surge in institutional involvement has been aided by spot BTC ETFs worldwide, which enhance liquidity and make the market more accessible. These ETFs have effectively created a bridge between traditional finance and cryptocurrency, offering investors a familiar way to engage with Bitcoin.

Bitcoin’s technological ecosystem has also seen notable improvements. The Lightning Network, a solution designed for fast and cheap transactions, bolsters adoption for everyday use. As Bitcoin becomes easier and more affordable to use, its role as both a store of value and a functional currency becomes clearer.

Inflation, Fed Policies Favor BitcoinAdding to the bullish outlook, macroeconomic conditions are playing into Bitcoin’s hands. Concerns about inflation, a weakening U.S. dollar, and expectations of rate cuts by the Federal Reserve make Bitcoin’s decentralized nature more appealing than ever.

“Lots of ink will be spilled on the pace of cuts going forward, little detracts from the supportive macro dynamic of a global central bank rate cutting cycle,” noted LondonCryptoClub’s founders.

Yet, it’s not all smooth sailing. Regulatory uncertainty in the United States continues to loom large. Restrictive policies or unexpected taxation could put a brake on institutional enthusiasm. Moreover, macroeconomic shocks such as sudden interest rate hikes could halt Bitcoin’s momentum.

What Do Past Cycles Suggest?Past cycles paint a fascinating picture of Bitcoin’s behavior. In 2013 and 2017, BTC soared past the red “Maximum Bubble Territory,” propelled by retail investors and speculative frenzy. However, the 2021 cycle was different. Bitcoin stalled in the “FOMO intensifies” phase, largely due to economic headwinds and a less feverish market.

This time around, things look more measured. Institutional participation and evolving regulations mean less volatility and fewer dramatic peaks and crashes. Bitcoin’s market is maturing, and the rally’s momentum reflects deeper liquidity.

“We suggest the risk of a ‘hawkish‘ cut… and inflation is on a bumpy path that allows the Fed to be patient,” Marc Chandler, from Bannockburn Global Forex, remarked recently.

If Bitcoin revisits the rainbow’s red zone, it could hint at a more extended, stable climb rather than a sudden spike. This possibility aligns with the idea of a “supercycle” — a prolonged period of sustained growth rather than a short-lived boom.

The Role of the Fed and Global MarketsBitcoin’s journey is also intertwined with the broader financial world. Recently, BTC surged past $106,000 before settling near $104,500. At the of writing, Bitcoin is trading at $106,444, according to Brave New Coin’s Bitcoin Liquid Index.

Source: BNC Bitcoin Liquid Index

Bitcoin’s recent surge was influenced by speculation about the Federal Reserve’s upcoming rate cut. The Fed was anticipated to reduce rates by 25 basis points, marking a total cut of 100 basis points since September.

Bitcoin Dips After Hawish CommentsThe U.S. Federal Reserve reduced its bnchmark federal funds rate by 25 basis points to a range of 4.25%-4.50%, marking its third consecutive rate cut this year and a cumulative reduction of 100 basis points since September.

This widely anticipated move came despite recent economic data showing robust growth and persistent inflation, shifting market focus to the Fed’s accompanying policy statement, economic projections, and Chair Jerome Powell’s press conference for insights on future monetary policy.

Key Highlights:Economic Projections and Policy Signals:

The Fed’s updated economic projections indicate that the federal funds rate is expected to decrease to 3.9% by the end of 2025, reflecting an additional 50 basis points in cuts next year. However, this forecast is less dovish compared to September’s 3.4% projection. Inflation expectations were revised upward, with Personal Consumption Expenditures (PCE) inflation for next year now forecast at 2.5%, up from September’s estimates of 2.1% for headline PCE and 2.2% for core PCE.

Market Reactions:

Bitcoin (BTC) saw a significant decline, dropping nearly 5% to around $101,000, while smaller cryptocurrencies like XRP, Cardano’s ADA, and Litecoin’s LTC experienced losses of nearly 10%. The S&P 500 index also fell to session lows as Powell spoke, highlighting broader market concerns.

Powell’s Press Conference:

Chair Jerome Powell attributed the slower anticipated pace of rate cuts to recent hotter-than-expected inflation data and elevated inflation expectations for the coming year. He acknowledged that the federal funds rate is nearing a “neutral rate,” suggesting less aggressive policy moves in the near term. Powell dismissed the idea of a government strategic bitcoin reserve under the Federal Reserve’s purview, citing legal restrictions under the Federal Reserve Act.

Macroeconomic and Crypto-Specific Risks:

Financial conditions remain tight despite rate cuts, with higher long-term bond yields, elevated mortgage rates, and a stronger U.S. dollar adding to macroeconomic pressures. Bitwise’s European Head of Research, Andre Dragosch, highlighted risks for cryptocurrencies due to dollar appreciation and tightening liquidity, although BTC-specific on-chain metrics remain favorable, such as declining exchange balances, which suggest a continued supply deficit.Overall, the Fed’s cautious outlook and the persistence of tightening financial conditions have raised concerns for both traditional markets and cryptocurrencies, particularly as the global macroeconomic environment becomes increasingly challenging.

It’s quite possible, however, that the current dip is a buying opportunity, and the rainbow chart may yet play out. Only time will tell.