During an Oct. 3 press conference, the International Monetary Fund (IMF) renewed its calls for El Salvador to scale back its Bitcoin policies and overhaul the regulatory framework for the digital asset.

Julie Kozack, director of the IMF’s communications department made this statement:

“What we have recommended is a narrowing of the scope of the bitcoin law, strengthening the regulatory framework and oversight of the bitcoin ecosystem, and limiting public sector exposure to bitcoin.”

Since El Salvador made Bitcoin legal tender in 2021, the IMF has consistently urged the country to move away from Bitcoin and adopt a more traditional financial infrastructure. In August 2024, the IMF repeated similar demands but admitted that many of the risks associated with Bitcoin adoption “have not yet materialized.”

IMF remains hostile to Bitcoin and crypto

The IMF’s opposition to Bitcoin is well-known. As fiat currencies continue to lose value globally, individuals—and to a lesser extent, nation-states—are slowly moving away from the debt-based fiat standard toward Bitcoin’s sound monetary principles.

In 2023, the IMF provided technical consulting to help Andorra record and monitor Bitcoin transactions. In March 2024, the organization suggested that Pakistan impose a capital gains tax on crypto to secure a $3 billion loan.

More recently, the IMF floated the idea of taxing energy used for crypto mining to reduce carbon emissions. This tax could potentially increase energy costs for miners by 85%, a heavy blow to an industry already facing challenges from post-halving economics and rising mining difficulty.

IMF pushes Central Bank Digital Currencies

While the IMF continues to oppose Bitcoin and decentralized cryptocurrencies, it is actively promoting central bank digital currencies (CBDCs) worldwide.

In September, the IMF unveiled the REDI framework for CBDC development. REDI stands for regulation, education, design, and incentives, and is intended to help central banks make CBDC adoption more appealing to the public.

El Salvador is Going Places

President Nayib Bukele has turned El Salvador into the safest country in the Americas. He rallied his citizens to stand up for his version of democracy by empowering lawful citizens and called on the global community (especially his critics, like the US and human rights groups) to reflect on the way they think about their democratic values. The speech followed sparring sessions with US representatives where he accused the US of blatant hypocrisy. The emboldened leader, jubilant in celebration was met with cheers of support from the hundreds of thousands that gathered to commemorate the beginning of his second term in February.

Bukele has become extremely popular, both domestically and abroad; Known for his charismatic social media presence and direct engagements with global leaders, Bukele has drawn both acclaim and criticism. With matters ranging from politics to economics; from philosophy to social change, Bukele doesn’t shy away from confrontations. Bukele stands as a pivotal and controversial figure, challenging constitutional norms by seeking this extended term, and has carved out a distinct persona for himself on the global stage that serves to propel his success.

Economic Vision and Reforms:President Bukele’s tenure is noteworthy for its strong emphasis on economic reforms, which includes the controversial adoption of Bitcoin as legal tender. This mandate was aimed at fostering financial inclusion and challenged traditional monetary policies and even the ideology surrounding government-issued currency.

His administration has prioritized entrepreneurship, innovation, and foreign investment, notably through projects like “Bitcoin Beach”, the Volcano Bond initiative, and significant investments in infrastructure projects like a new airport and rail system to support growth in the region to both bolster growth and cater to the expected influx of visitors.

Governance and International Relations:Bukele’s approach to governance, characterized by fiscal responsibility and efforts to streamline government operations, has garnered both praise and criticism. His aggressive stance towards his many international critics, including the United States, the European Union, and the IMF, adds complexity to his leadership style. While these tirades make him popular amongst libertarian-leaning folk and those who view the International Relations status quo as exploitative, he has few fans in the established order of the West as might be expected.

When push comes to shove, however, a key driver of political success is having a positive influence on the economy. One cannot argue with the performance of Bukele, as seen by El Salvador’s improving debt position. The county’s credit rating recently rose to B-.

Looking ForwardNayib’s controversial first tenure was marked by a series of bold initiatives aimed at positioning the country as a forward-thinking player in the global economy but drew the ire of skeptical onlookers. There has been scrutiny around his record on human rights, legal jawboning, and rumored dark deals with the underworld as well as concerns regarding the concentration of power and the swift adoption of Bitcoin – even amongst the Maxi-class.

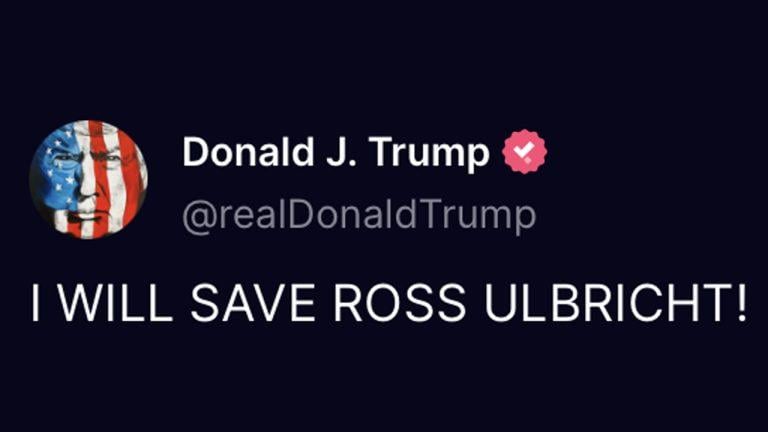

Despite these controversies, one cannot deny the positive impact on the economy and civil safety that Bukele has made, which naturally creates compounding benefits for the country. At just 42, Nayib Bukele’s leadership continues to be a blend of disruption, popularity, and controversy. Often likened to figures like Donald Trump and Elon Musk for his personal engagement with the public via social media, Bukele’s tenure has been marked by strong support and criticism alike. His approach to governing, blending populist strategies with market-friendly policies, will leave a complex legacy as he leads El Salvador into a new era. As Bukele navigates his extended tenure, the world watches how his policies will shape the nation’s future and its place in the global community.

He is unlikely to take advice from the IMF.