Key Takeaways:

U.S. states, such as Kentucky and Missouri, are now looking into Bitcoins as an alternative reserve asset. The states aim to hedge against inflation and embrace technological innovation. Balancing potential gains with the need for robust regulation and security is crucial.The integration of Bitcoin into state financial models is gaining significant momentum, with Kentucky and Missouri emerging as key players in this evolving landscape. As the 16th US state to introduce legislation directed toward the establishment of the Bitcoin reserve, Kentucky’s decision to adopt digital money at the state level is an example of the digital asset, following in the traditions of the states, such as Missouri and Utah. The growing acceptance of Bitcoin as a store of value and an economic tool is a natural outcome of its increasing recognition. However, it is also causing a lot of difficulties while regulation, risk management, and the future of finance are being discussed.

Kentucky’s Bold Step: HB376 and the Pursuit of Digital Asset DiversificationKentucky’s bill, KY HB376, introduced by State Representative Theodore Joseph Roberts, marks a significant step towards legitimizing Bitcoin as a legitimate asset class within the state’s financial framework. The bill, if established, will allow the State Investment Commission the right to assign a maximum of 10% of the surplus state reserves to investment in digital assets, and Bitcoin will be the main beneficiary as it tops the list of digital currencies by market capitalization.

The language of the bill, while not explicitly mentioning Bitcoin, effectively targets the cryptocurrency by setting a minimum market capitalization threshold of $750 billion that only digital assets with a fully deserved reputation could surpass. As of early 2025, Bitcoin was the only cryptocurrency that met this criterion, holding a market cap significantly higher than its competitors.

In the case of early 2025, Bitcoin’s market capitalization skyrocketed to almost $1.9 trillion making it the storm in the cryptocurrency sector. On the other hand, Ether’s market capitalization was about $330 billion, which highlighted the gaping differences in scale and strength.

Such initiatives by Kentucky reinforce the belief that Bitcoin could serve as an effective hedge against inflation and a means to diversify the state’s investment portfolio. The state would be able to reduce their dependence on traditional assets such as stocks and bonds. However, the decision to use state funds for Bitcoin might also convey risks including the digital currency’s well-known instability and the possibility of the market’s depression.

Missouri Follows Suit: HB1217 and the Vision of a Bitcoin Strategic Reserve FundNot to be outdone, Missouri is also actively exploring the possibility of establishing a Bitcoin Strategic Reserve Fund. Ben Keathley, a Missouri State Representative authored House Bill 1217 that provides for the internalization of such a fund to diversify the state’s investment portfolio and protect against the erosion of purchasing power caused by fiat currency inflation.

HB1217 would empower the Missouri state treasurer to acquire, invest, and hold Bitcoin under specific conditions, broadening the state’s investment authority and opening new avenues for financial growth.

Today I filed HB 1217 which would authorize Missouri to hold and accept Bitcoin for state payments. This will help diversify our state’s portfolio while hedging against inflation. #moleg https://t.co/tokLpGlWMJ

— Rep. Ben Keathley (@benKeath) February 7, 2025

The bill consists of an innovative stipulation demanding that all the government bodies in Missouri must permit the use of cryptocurrency for authorized transactions, such as taxes, fees, and fines. This innovative move could position Missouri as a leader in digital asset adoption, driving greater integration of these assets into the state’s economy.

A noteworthy account: Representative Keathley announced his backing for Bitcoin and his view that it could be a useful tool for protecting the financial interests of the state. He stressed the need for spreading out Missouri’s investment portfolio and limiting its exposure to the risks associated with traditional financial assets.

Notice that despite the expected effective date of HB 1217 being August 28, whether the bill has been approved requires checking the most recent legislative records.

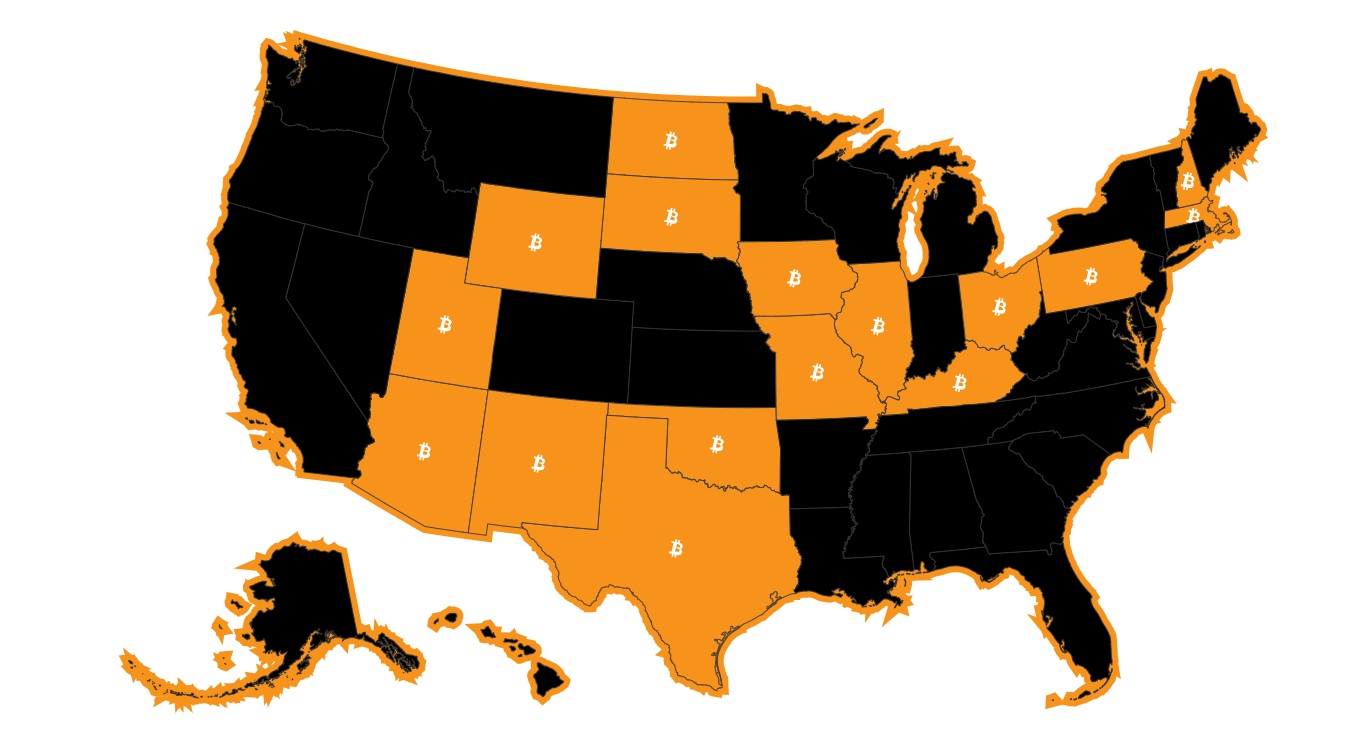

The National Landscape: A Growing Movement Towards Bitcoin AdoptionThe activities in Kentucky and Missouri do not happen independently but are part of a larger trend taking place in the U.S. Based on the data provided by bitcoinlaws.io, there are many states that are taking part in the discussion or are considering the passage of legislation on Bitcoin reserves. These states are Arizona, Alabama, Florida, Massachusetts, New Hampshire, North Dakota, South Dakota, Ohio, Oklahoma, Pennsylvania, Texas, Utah, Kansas, and Wyoming.

US states with Bitcoin reserve bill propositions. Source: Bitcoinlaws

More News:

Bitcoin Reserve Odds Surge Texas Considers Establishing a Bitcoin Reserve in 2025 Under Lt. Governor Dan Patrick Ohio Takes the Lead in the Cryptocurrency Race: Is Bitcoin Becoming a State Reserve Asset?For example, Utah is not lagging behind in terms of setting up a Bitcoin reserve but has in fact been quite active in its plan to establish such. The passing of the bill by the House and sending it to the Senate is proof of this, and the state of Utah is also considering authorizing its treasurer to channel up to 5% of the public funds to “qualifying digital assets,” this would include Bitcoin.

Still, the road to the adoption of Bitcoin is not always smooth. The legislative setbacks in North Dakota and Wyoming highlight the challenges states face in securing approval for Bitcoin reserve bills.

State-level interest in Bitcoin reserves has intensified, sparking discussions about the potential creation of a national Bitcoin reserve. At that time, then-President Trump made a decision for the administration to “evaluate the potential creation and maintenance of a national digital asset stockpile.” Senator Cynthia Lummis submitted a congressional bill for the U.S. reserve, with the proposal that the country should obtain something like $20 billion worth of Bitcoin during the first year and a further 200,000 BTC in each of the following four years.

The Road Ahead: Challenges and OpportunitiesThe adoption of Bitcoin in state and national financial systems may seem ambitious, but its volatility presents significant challenges. Legislators and blockchain companies are finding it hard to set up the rules for digital asset markets, which can be very risky and even lead to hacking and loss in case of cyberattacks.

A real-world example: The cryptocurrency exchange FTX suffered its collapse in 2022 proving the fact that the process of dealing with unregulated digital asset platforms is riskier than recognized before. Its effect has shocked the cryptocurrency market and shown the weakness of investment security in blockchain technologies.

On the other hand, integrating Bitcoin into state financial systems could unlock economic growth, drive innovation, and contribute to financial stability at both the state and national levels. Nations may blend traditional and digital assets to drive sustainable economic growth and strengthen financial resilience.

A key consideration is that market volatility and consumer protection must remain central to discussions surrounding the bill. On a positive note, Kentucky’s pro-Bitcoin stance could have a significant stimulative effect on the investment world. It can cause other states and countries to start considering the same. But adoption isn‘t just about price; it‘s about infrastructure. Kentucky will need robust custody solutions, cybersecurity measures, and a clear exit strategy if things go south.

As the Bitcoin reserve movement gains traction, policymakers, regulators, and industry leaders must engage in open discussions to navigate challenges and capitalize on emerging opportunities. Through collaboration, they can design a regulatory framework that nurtures innovation, safeguards consumers, and encourages the responsible adoption of digital assets.

The post Kentucky and Missouri Lead the Charge: The State-Level Bitcoin Reserve Revolution Heats Up appeared first on CryptoNinjas.