The court’s brief order on December 11 dismissed Nvidia’s appeal, allowing the case to proceed while offering no explanation for its decision. The ruling upholds a Ninth Circuit appellate court decision that revived the lawsuit after a lower court’s dismissal in 2021.

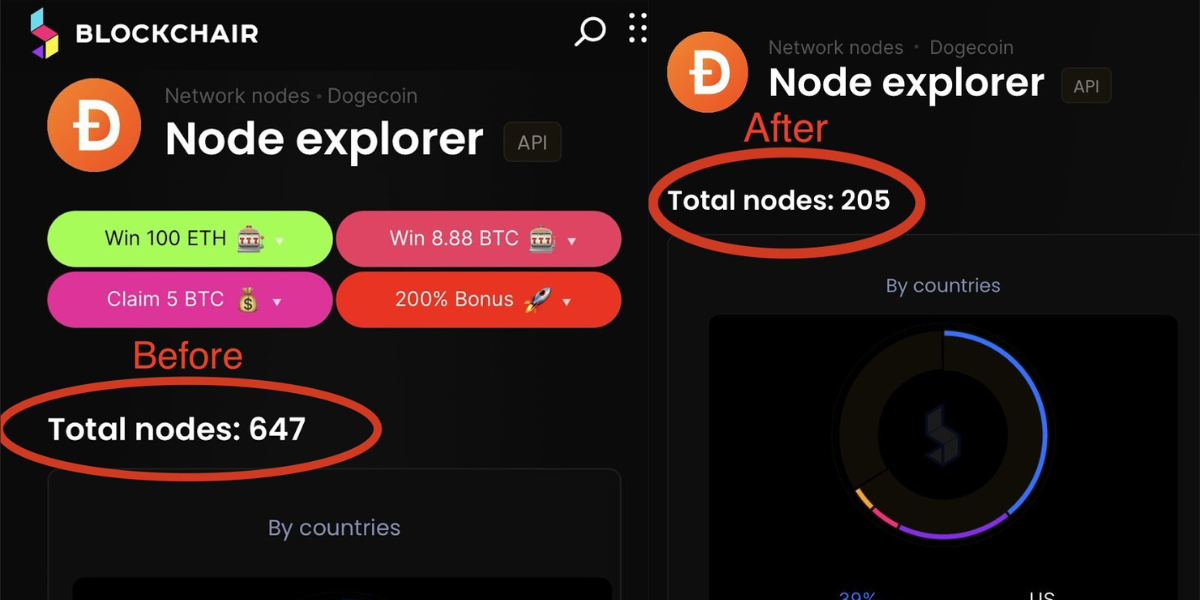

Originally filed in 2018 by a Swedish investment firm, the lawsuit claims Nvidia understated its GPU sales to cryptocurrency miners, falsely attributing the surge in revenue to its gaming division. Investors allege the company concealed over $1 billion in crypto-related sales, a move that artificially inflated its stock price. When the cryptocurrency market crashed later that year, Nvidia’s revenue fell short of projections, triggering a 28% drop in its share price within two days.

The Supreme Court allows investor lawsuits against Nvidia. Source: Supremecourt/gov

The plaintiffs have presented evidence, including statements from former Nvidia executives and a Bank of Canada report, to support their claims. The report alleges Nvidia understated its cryptocurrency revenue by $1.35 billion, further bolstering the investors’ case.

Deepak Gupta, the attorney representing the investors, hailed the Supreme Court’s decision as a victory for corporate accountability. “When corporations mislead shareholders, they undermine trust in our markets. Ensuring that investors can seek justice is essential to preserving fairness and transparency,” he said in a statement.

Nvidia’s Defense and Past SettlementsHeadquartered in Santa Clara, California, Nvidia said it has done nothing wrong. The company said the complaint relies on fabricated expert opinions and fails to meet the pleading standards of the 1995 Private Securities Litigation Reform Act designed to end frivolous lawsuits.

An Nvidia spokesperson expressed disappointment over the Supreme Court’s decision but said that the company is prepared to defend itself: “We would have liked a decision that agreed with the trial court’s dismissal of the case, but we are completely ready to keep defending ourselves,” said the spokesperson.

Nvidia has already run afoul of authorities over its cryptocurrency disclosures. It settled with the SEC in 2022 for $5.5 million, alleging that it had not adequately disclosed how crypto mining affected its gambling operations. Nvidia did not acknowledge or refute the SEC’s conclusions at the time.

Chinese authorities are looking into Nvidia for potential anti-monopoly law infractions. An investigation running parallel to a decision by the Supreme Court ups the ante on the moves by the company. Nvidia has not commented on the investigation, but surely this news does raise aspersions about its adherence to the rules in world markets.

Mixed performance during the legal issuesDespite all the challenges on the legal front, some factors have been big contributors, and the stock of Nvidia performed quite well. Shares in the company have gained 180% this year, boosted by an early lead in the market trading in AI, where Nvidia’s GPU performs an integral role in the training and running of the AI systems, something quite important in technology.

However, those lawsuits and investigations tarnish that recent success. Critics say Nvidia’s opacity and rough-elbowed business practices may undermine investor confidence down the line and invite even more regulatory scrutiny.

The class action against Nvidia forms part of a trend wherein investors take some of the most valuable technology companies to court. On the same day, in a different class-action case related to the data-scandal Cambridge Analytica, the Supreme Court similarly rejected Meta’s, the parent company of Facebook, appeal. In all cases, it has been shown that such courts would not hesitate to make companies answer for whatever deception.

As Nvidia readies arguments for its defense in court, the outcome of this suit might change how tech giants detail their financial involvement in some pretty volatile industries, like cryptocurrency. The case has now become a cautionary tale about the dangers of choosing short-term gain over accountability in the longer term.