The U.S. District Court issued its ruling on November 1, bringing a conclusion to a high-profile case that highlights growing concerns over transparency and accountability in the NFT and digital asset sectors.

According to a Bloomberg report, Michel, a French national, was given one month in custody–—time he had already spent before the verdict. U.S. District Judge Margo Brodie also decided not to send him to prison for the longer length of time requested by the prosecution, 37 months. She partially accounted for her decision based on the ambiguity over how much real financial loss was involved, as Michel’s defense maintained that investors did indeed receive digital artwork-just very low in value.

“What that value is, is unclear,” said Judge Brodie during the trial, as it was clear that while Michel and his team had managed to raise almost $3 million from the project, the intrinsic value of NFTs is a matter of debate.

His Mutant Ape Planet collection hived off from Yuga Labs’ popular Mutant Ape Yacht Club, first gained significant momentum in early 2022. The collection of 6,797 NFTs on the Ethereum blockchain could amass sales with a total value of 567 ETH. However, as its promises were never met, investors’ confidence and market value started to nosedive, raising questions about the legitimacy of the project.

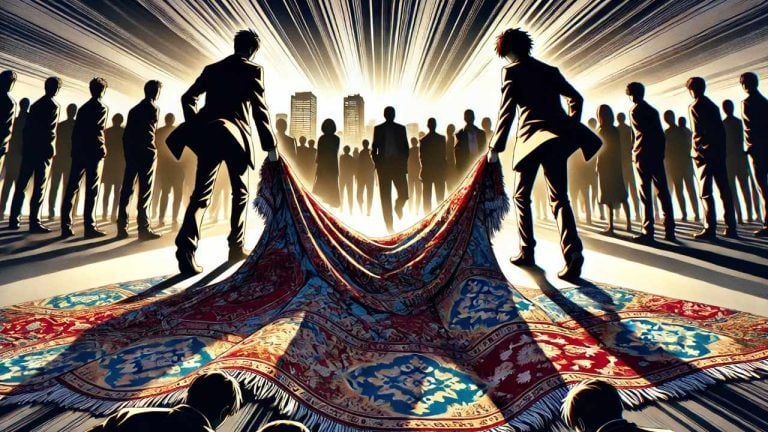

The court cases of Michel began in January 2023, after his arrest because he had organized a “rug pull“-just abandoning the project and not providing any promised benefits. Homeland Security agents discovered that Michel had confessed to the fraud in a social media post, stating, “We never intended to rug but the community went way too toxic.” This admission underscored his intent to withdraw from the project, leaving investors without recourse.

The scheme involved promoting various rewards such as staking-enabled tokens, merchandise, and metaverse land, which were never delivered. Investors were instead left with digital assets that lost their initial appeal and market value, complicating efforts to quantify investor losses.

Defense Arguments and Sentencing OutcomeMichel’s attorneys contended that while the project did not live up to its promises, investors still received digital artwork, which holds some value in the NFT space. This argument resonated with the judge, who emphasized that determining an exact loss in the case of digital collectibles is challenging due to fluctuating NFT values.

Judge Brodie’s ruling reflects a cautious approach, taking into account the complex nature of digital assets where value is often subjective. In addition to the financial penalties, Michel was issued a warning regarding future engagements in the NFT market. In a statement, prosecutors said the case shows the potential risks for investors in digital assets, particularly when the originators of those assets fail to follow through with promises concerning the projects.

The case of Mutant Ape Planet is a sobering lesson to the new industry of NFTs, with their clarion calls for more transparency and accountability. As much as NFT markets open unparalleled investment opportunities, cases like Michel’s have exposed their vulnerabilities to investor losses.

A decision in Michel’s case could set the precedent for how regulators approach digital assets in the future, perhaps even moving to stricter guidelines to help investors avoid falling victim to similar projects.