Analysts from 10x Research and other industry leaders warn that Federal Reserve policies could temper market enthusiasm, even as the cryptocurrency eyes significant growth.

Markus Thielen, chief executive at 10x Research, expects a strong start to January and optimism ahead of the Consumer Price Index (CPI) inflation data release on January 15. A good CPI could further strengthen the ongoing Bitcoin rally going into the Trump inauguration on January 20.

Thielen does believe, however, that this momentum will be short-lived as the January 29 FOMC meeting draws near. He projects Bitcoin to be in the range of $97,000-$98,000 by the end of the month.

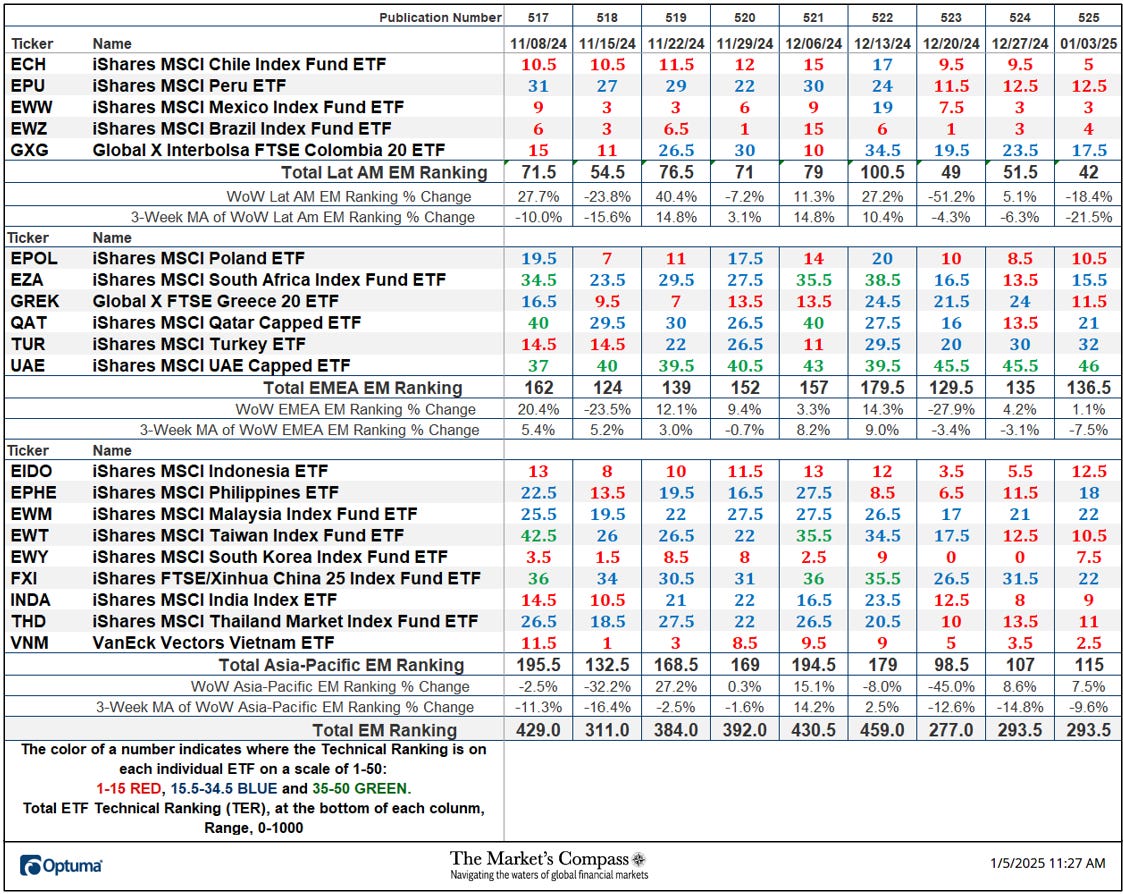

Federal Reserve Policies Remain a Key RiskCommunications from the Federal Reserve are considered the “main risk” to Bitcoin’s continued rally. At the time of writing, the chances of federal rates staying in the range of 425-450 basis points after the FOMC meeting were 88.8%, according to FedWatch, a tool developed by CME Group. Historically, Bitcoin has been very volatile after decisions from the Fed. In December 2024, Bitcoin fell as much as 15% to $92,800 after the Fed trimmed its expected 2025 rate cuts.

Bitcoin’s projected path for January 2025 amid Fed rate uncertainty. Source: 10X Research

Thielen points out that while inflation may go down in 2025, the Federal Reserve will likely be slow to adjust its monetary policies. “The pace at which institutional investors return to the crypto market will also play a critical role,” he added, citing stablecoin minting and Bitcoin ETF inflows as key indicators to watch.

Long-Term Projections and Bitcoin DominanceAnalysts are nevertheless optimistic in the long term. John Glover, the chief investment officer at crypto lending firm Ledn, thinks that Bitcoin could reach $125,000 by the end of Q1 2025, peaking possibly at $160,000 later in the year. Other targets by asset management companies such as Bitwise and VanEck have pegged Bitcoin to reach highs of $200,000 before the year ends.

Bitcoin (BTC) price chart. Source:Bitcoin Liquid Index (BLX) viaBrave New Coin

Bitcoin dominance went down to about 57% at the end of 2024, showing just how strong control the cryptocurrency has on the market. “This consolidation underlines the leading role that Bitcoin plays within the crypto space,” said Thielen.

Altcoins have struggled to keep pace with Bitcoin’s lead, and Ethereum, in particular, faces a challenging year. Thielen described Ethereum as a “poor medium-term investment” in a December 30 report, citing its declining active validator growth and insufficient demand outside staking.

Outlook for the Crypto MarketAs 2025 unfolds, the interplay between political events and economic policies will shape Bitcoin’s performance. While Trump’s inauguration is expected to bolster market sentiment, Federal Reserve policies could act as a counterweight, introducing volatility into the market. Investors are advised to monitor CPI data, FOMC outcomes, and institutional activity closely, as these factors will heavily influence Bitcoin’s trajectory.