Accusations have ignited significant outflows, a sharp drop in its token price, and questions about the platform’s security infrastructure.

North Korean Exploitation Claims EmergeThe controversy began when Taylor Monahan, a security expert from MetaMask, alleged that wallets associated with the Democratic People’s Republic of Korea (DPRK) were trading Ethereum (ETH) on Hyperliquid. Monahan claimed the trades were not standard transactions but potential vulnerability tests aimed at the platform. “DPRK doesn’t trade. DPRK tests,” Monahan asserted in a social media post.

Her allegations sparked widespread panic among Hyperliquid users. Data from Dune Analytics revealed that over $256 million in funds were withdrawn from the platform in just 30 hours, with December 23 alone witnessing net outflows exceeding $502 million.

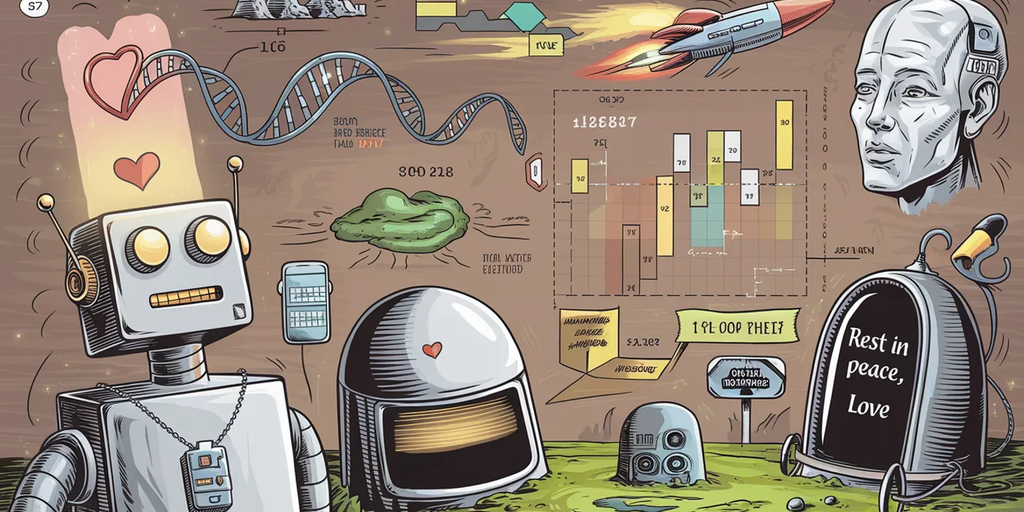

Hyperliquid (HYPE) price chart. Source: Brave New Coin

Hyperliquid’s native token plummeted by over 25%, falling from $34 to $25 before stabilizing at $27. Although the price has since rebounded, the controversy has dented investor confidence in the platform.

Hyperliquid Denies AllegationsIn response to the escalating concerns, Hyperliquid Labs released a statement denying any security breach. “There has been no DPRK exploit—or any exploit for that matter—of Hyperliquid. All user funds are accounted for,” the platform assured through its Discord channel.

The company emphasized its commitment to security, citing its bug bounty program and adherence to industry standards in blockchain analytics. Despite these reassurances, questions about the platform’s infrastructure remain, particularly its reliance on just four validators to secure billions of dollars in assets.

Experts Highlight Security FlawsCritics have pointed to Hyperliquid’s validator system as a significant vulnerability. With $2.3 billion in USD Coin (USDC) bridged on Arbitrum One, the platform relies on a two-thirds quorum for transaction approvals. A compromise of just three validators could allow attackers access to the entire pool of funds.

Source: X

Developer Cygaar proposed potential countermeasures, such as blacklisting malicious addresses through USDC issuer Circle or rolling back transactions via the Arbitrum multi-signature council. However, these options are fraught with challenges. Laurence Day, co-founder of Wildcat Labs, dismissed rollback proposals, stating such actions would only be considered during an “existential crisis.”

The Hyperliquid incident occurs amid increasing reports of North Korean cyberattacks. According to Chainalysis, hackers linked to the DPRK have stolen over $1.3 billion in cryptocurrency in 2024, a sharp increase from the $660 million stolen the previous year. The regime reportedly uses these funds to circumvent international sanctions, further intensifying concerns over crypto security.

Looking AheadWhile Hyperliquid continues to deny any breach and reassures users of its platform’s security, the fallout from these allegations underscores the vulnerabilities in decentralized finance (DeFi) ecosystems. The incident highlights the need for robust security measures, transparent communication, and proactive defense mechanisms to maintain user trust and ensure the integrity of digital asset platforms.

As investigations continue, stakeholders in the crypto industry are likely to keep a close watch on Hyperliquid’s response and the broader implications for DeFi security standards.