The rally pushed major cryptocurrencies higher, with Bitcoin gaining 2.8% in the past 24 hours, while Ethereum (ETH) and Solana (SOL) rose by 3% and 5%.

Source: BNC Bitcoin Liquid Index

As Bitcoin surged, over $100 million worth of short positions, or bets against the asset’s price, were liquidated, per data from CoinGlass. This added further fuel to the rally.

The weekend also saw strong activity in memecoins, as speculative chatter about a possible “supercycle” spread among traders. Mog (MOG) extended its seven-day gains to 20%, while SPX6900, a meme coin, saw a 135% increase.

The rise of memecoins comes amid a broader lull in other sectors of the crypto market, including layer-2 networks and storage solutions. Sentiment around tokens backed by venture capital has also soured, with many traders viewing them as overpriced and unfavorable for retail investors.

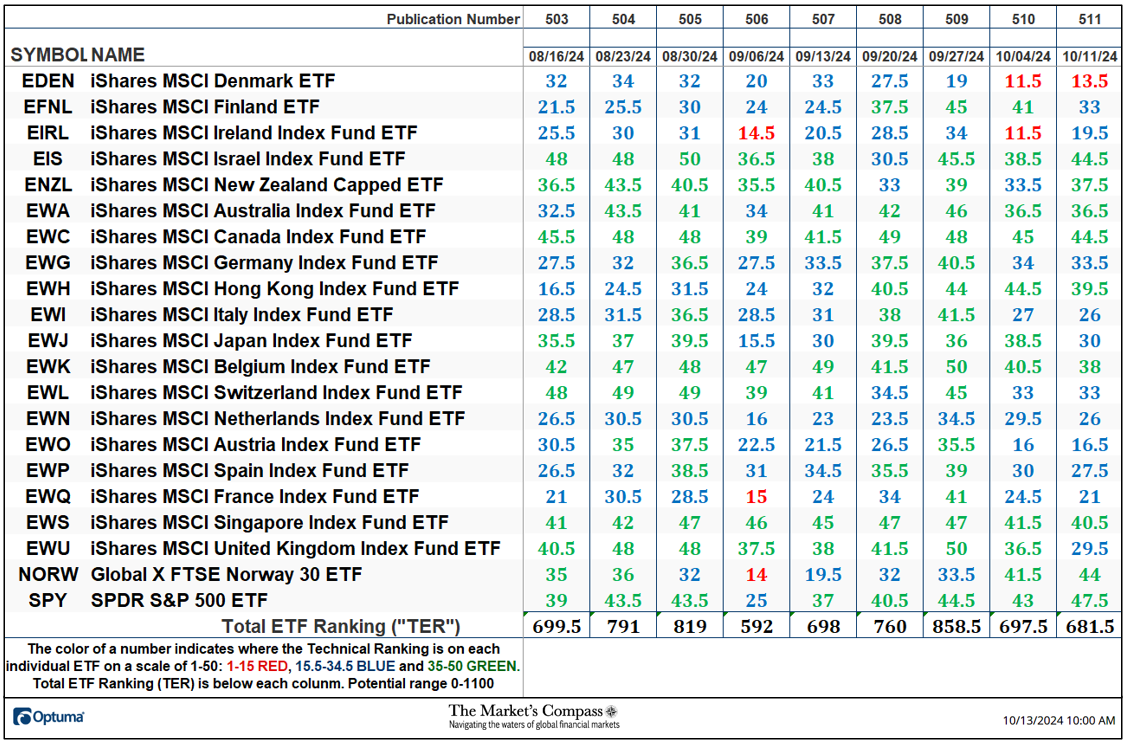

China’s StimulusBitcoin’s latest push higher coincided with a boost in Chinese equities, driven by renewed hopes for government stimulus. China’s finance minister, Lan Fo’an, indicated over the weekend that new measures to support the country’s property sector were forthcoming, along with hints of increased government borrowing. While the announcement was less than expected, it was enough to spur risk sentiment in global markets, including Bitcoin.

U.S. markets last week saw strong inflation data, with both the Consumer Price Index (CPI) and Producer Price Index (PPI) exceeding expectations. This initially confused markets, but ultimately the consensus was that core inflation trends remain steady. U.S. stocks hit new all-time highs, particularly in high-beta sectors, and the U.S. dollar rallied further. Traders continue to anticipate an 85% chance of a 25 basis point rate cut by the Federal Reserve in December, fueling optimism in both traditional and crypto markets.