Are overreaching ESG standards, which often target Bitcoin's energy consumption, politically dangerous?

The below is a direct excerpt of Marty's Bent Issue #1077: "More Unsolicited Thoughts On ESG." Sign up for the newsletter here.

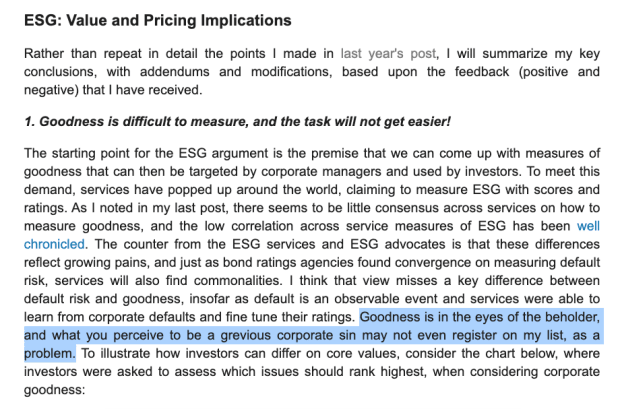

via Aswath Damodaran's Musings on MarketsI know, I know, I know. Some of you may think Crazy Uncle Marty's anti-ESG schtick is getting a bit nauseating. However, as you should have realized by now, I cannot control myself. When I think there is a good point to be made about the subject, I will make it. And that is what I am here to do today.The above snippet comes from a blog posted yesterday by Aswath Damodaran, a professor of finance at the NYU Stern School of Business, which builds on a post he published last September that began to dissect the ESG movement in the capital allocation space and beyond to determine whether or not it is a productive framing to conduct business and life. I highly recommend you take the time to read both pieces because Aswath does an incredible job of breaking down the thesis behind the investment strategy, how it gets implemented in the real world, its failure to accomplish its stated goals, why it can never accomplish its stated goals, and a better framework from which to approach "doing good".To summarize the core argument that Aswath makes; ESG does not work because it ignores the existence of free will and reduces individuals and individual processes into uniform inputs in a rigid mathematical function that spits out an ESG rating. At its core, this type of grading/rating system cannot work because, again, it ignores the existence of free will and the subjectivity of "goodness" in the eyes of two different individuals. It is literally impossible to settle on a ratings system that people are able to agree on. And since that is the case, any ratings system that is brought to market will inherently carry the biases of those who construct it; governments looking to acquire more power over their subjects and corporations looking to leverage advantages provided by regulatory moats.Not only that, when these investment strategies are applied, they do not produce a return profile that is desirable. So this movement is crowding smaller players out by increasing the cost to comply and producing bad returns for investors. A lose-lose for most economic actors.Now, if this is the case why are so many people pushing for it? Well, as Professor Damodaran so eloquently describes in his latest post on the subject; because most individuals don't want to take personal responsibility and extreme ownership over their impact on the world. Many are so lazy that they would rather have the government, capital allocators, and corporations make these decisions on their behalf and provide them with an "ESG-certified" label they can point at and say, "See, I'm doing my part!" Completely glossing over the fact that when these personal responsibilities are handed over to bureaucrats, bureaucrats are going to do what bureaucrats do - whether they're political or corporate bureaucrats - manipulate the system in their favor while making everyone else worse off.Politicians will attempt to gain more control and some corporations will attempt to leverage it to create an artificial moat around their businesses to artificially reduce competition. Which leads to another interesting line of discussion under the overarching ESG topic; is it a form of Fascism? I think you could make a very good case that yes, yes it is. And nothing made this clearer to me than a clip that was floating around Twitter earlier this week of Dave Smith educating a fellow panelist about how Mussolini defined Fascism.

"He defined it as a merger between Corporation and state."While Dave may have been articulating this to make a point about how vaccine mandates can be considered Fascist, I think we can also apply this to what is happening throughout the ESG movement. Via the direction of the UN (a group of coordinated countries - the state) and the "climate change goals" they have arbitrarily set for the global population, corporations and capital allocators are beginning to direct the means of production and pick winners and losers via an ESG ratings system built around those arbitrary and subjective world views. Favoring some forms of energy and boardroom structures over others while failing to be open about the tradeoffs that are being disregarded. A good example of this is wind and solar being favored as energy sources for being "green" when they leverage an immense amount of hydrocarbons and slave labor on the front and back end of their lifecycles.By creating arbitrary and rigid guidelines which entrepreneurs must operate within, the state and the corporations who are best positioned to benefit from these arbitrary guidelines dictate the means of production in a subversive fashion. There is no overt physical seizing of the means of production. Instead, the means of production is slowly but surely nudged in a certain direction until the desired amount of control is in the hands of the state and its corporate cronies.As a bitcoin miner, this issue has become very clear to me. In a sane world bitcoin mining would be viewed as a massive boon for conservationism. For the first time in human history we have a mechanism by which we can profitably monetize previously wasted and stranded energy assets. The natural incentives of the network force miners to drive their electricity costs down as low as possible and the best way to do that is to seek out wasted and stranded energy sources that no one else is willing to utilize. Bitcoin miners will show up in the middle of nowhere to utilize energy that was LITERALLY BEING SET ON FIRE without producing any positive economic value. Definitionally making the world more energy efficient.Not only this, but the miners utilizing that previously wasted energy are doing so to profitably facilitate and secure the best monetary system humanity has ever come into contact with. A monetary system which will end the mis-pricing of opportunity costs that is induced by the ability to print money out of thin air. As Steve Barbour said during a conversation on the topic we were a part of earlier this afternoon, it punishes the misallocation of capital, which leads to less unnecessary consumption. When governments and central banks print money out of thin air to save companies that have misallocated capital and resources to an extent that they are in danger of going out of business, they perpetuate that misallocation of capital and resources, which one can argue is a net negative on the environment and society overall.I'm sorry for rambling, freaks. I just had to get these thoughts off of my chest after reading Aswath's blog last night and partaking in a conversation on the subject this afternoon. I will leave you with the actionable advice from Aswath's blog post, which I think is a much better framework for individuals, business, and investment professionals to approach the concept of "doing good in the world". It should be based on your personal values and not a top-down diktat defined by a very narrow set of values.

via Aswath Damodaran's Musings on Markets