As the USD’s reserve currency status crumbled, the U.S. will abandon globalization and adopt a bitcoin standard.

In the Bitcoin community, we often hear the U.S. dollar called an “exorbitant privilege.” Namely, that the U.S. benefits disproportionately from the dollar’s reserve currency status. This article will detail why the current financial system has, in fact, been a burden on the United States, why the fiat dollar system is ending and what that means for the future of Bitcoin.

BackgroundFirst, what is a global reserve currency? In short, it is the currency that governments and large international entities like central banks hold to facilitate global trade, credit, accounting and often to back their own currencies. The U.S. dollar holds this position today.

The dollar’s reserve status was officially established in the Bretton Woods Agreement of 1944. Since the U.S. was the only major economy left standing after World War II, it was only natural that the U.S. dollar would be agreed upon to anchor a new system. According to Bretton Woods, major currencies were pegged to the U.S. dollar, which in turn was pegged at $35 per ounce of gold.

This system initially served the world well, enabling rapid rebuilding after WWII, especially in Europe, Japan and several emerging markets. It was also an integral part of the fight against communism. Countries were welcomed into this system of international finance and trade as long as they were willing to side against the Soviets. However, the Bretton Woods design soon ran up against limitations. The gold backing restrained the dollar’s supply, despite the demand for currency around the world growing exponentially. Enter the Triffin dilemma.

Triffin DilemmaThe Triffin dilemma was first articulated in 1959 by Robert Triffin. The main idea is, when a currency is used as an international reserve, domestic constraints clash with international demand. The high demand for dollars and the limits of gold on the supply create an incentive for the U.S. to run large trade deficits and debase the currency. If that were the end, it would be that simple, but a new incentive breeds a market reaction as well.

Despite what many bitcoiners and macro pundits think, 1971 was not a particularly pivotal year. The famous events of that year, namely the Nixon Shock, were a natural progression, a recognition of the reality in the financial system established years before. By the time the Triffin dilemma became generally recognized in the 1960s, it was already being solved. The market always finds a way.

Instead of needing the Federal Reserve or U.S. government to meet international demand by printing and exporting dollars to the world, banks everywhere could do it for themselves by making dollar-denominated loans. This is how all credit-based fiat is printed, in the process of a loan. The Eurodollar system formed as a global interbank system and had unofficially replaced Bretton Woods prior to 1971.

The Eurodollar SystemThe Eurodollar is the current financial system consisting of off-shore U.S. dollars and dollar liabilities that are not beholden to the Fed or U.S. government policy. Enterprising bankers solved Triffin’s dilemma by printing dollars outside the U.S.

Source: BIS Working Papers No 684, “Triffin: dilemma or myth?” Bardo and McCauley, 2017These off-shore (or shadow) dollars trade one-to-one with actual U.S. dollars, because, well, they are U.S. dollars. In a quirk of credit-based fiat money, it is printed in loans denominated in that currency. A commodity-backed money is either fully backed or not. There is a measure of the commodity in a vault somewhere, and an objective ratio of currency to backing that shows debasement. But credit-based fiat has nothing to distinguish a dollar created by a bank in the U.S. from one created by a bank in, say, Singapore.

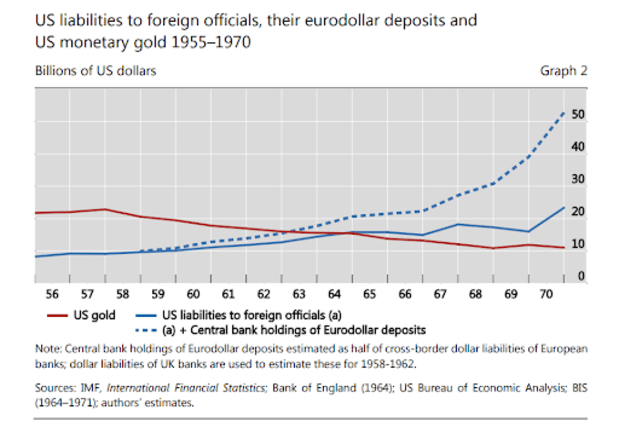

The Eurodollar system had its roots in the late 1950s, and grew with the insatiable demand for dollars that trade deficits couldn't meet. By 1970, the off-shore Eurodollar supply held by central banks was larger than the official overseas dollar supply (see chart above).

This emerging financial system was completely missed in the early days because it didn’t fit into economists’ models. The Eurodollar system remained unstudied for years with only a few brave economists risking their careers to look into things that didn’t fit into the reigning models. By 2020, the Bank for International Settlements’ (BIS) estimated there to be $12.7 trillion in measurable USD-denominated debt originated and held outside the U.S. However, this is only a small piece, because it doesn't consider derivatives, chains of custody, currency swaps, or other shadow products, making the effective sum many times higher. That’s why it’s called “shadow banking,” we don’t know the true extent of their balance sheets.

As long as the loans can be serviced, the system will keep ticking along. That means these loans must be productive and yield cash flow greater than principal and interest of the loans. Since money in this credit-based Eurodollar system is constantly revolving debt, the smallest interruption in the web of trust and credit ratings can cause a financial crisis.

Eurodollar And Free Trade SubsidyIf the Eurodollar's elasticity was the right hand of the dollar, open access to most of the world's markets was the left. Countries being secure from regional wars and their goods having access to almost all markets is a historical anomaly. Prior to the middle of the 19th century, integrated markets as we know them today did not exist, and until WWII, international trade was concentrated to a few goods and trading partners within networks of colonial possessions. The post-WWII era, which introduced international institutions like the UN, WTO and NATO, was paid for by the U.S. This U.S. subsidy in the form of a security and trade umbrella enabled the global economy to grow like never before.

Many people get this dynamic wrong. They see U.S. involvement throughout the decades in Korea and Vietnam, then Central America, then Iraq, Libya, and Afghanistan as U.S. imperialism, instead of it primarily benefiting others in the security umbrella. The U.S. military was expanding influence and control over these particular areas of operation, not for the sake of a U.S. empire, but to maintain an international system which favored others. The Pax Americana was about avoiding incidents like Sarajevo 1914 or Poland 1939.

This does not excuse U.S. atrocities and immoral behavior, but it is important to realize the U.S. was not the major beneficiary. Who was hurt most by the global wars in the 20th century? Not the U.S. In fact, the period since WWII, supposedly the era of the U.S. empire, was marked by the hollowing out of the U.S. economy and huge U.S. trade deficits, as the rest of the world flourished using Eurodollars.

Reserve Currency As A BurdenThe United States is a relatively new creation. It didn’t reach its continental boundaries until after the Mexican-American War of 1848. What followed was two decades of internal political restructuring and intercontinental infrastructure building, culminating in 1869 with the completion of the intercontinental railroad. From that point, it took two more decades for the U.S. to become the largest economy in the world, long before the world wars of the 20th century.

Indeed, by 1914, U.S. GDP was twice the size of the second largest economy, and roughly 20% of global GDP. I give these numbers to show the U.S.’s position prior to the Federal Reserve and prior to having the global reserve currency. It was already dominant and expanding its lead.

The reason for this dominance is not due to the U.S. dollar as a reserve currency. When leaders from around the world were meeting at Bretton Woods, the U.S. was responsible for 50% of the global GDP, an entire half of the world’s economy and probably a greater percentage of the world’s accumulated capital. Bretton Woods did not expand the U.S.’s share, it caused it to drop.

A common rebuttal is, “WWII destroyed much of the European economy, so that’s why the U.S. was so dominant at the time.” That is true, but it’s part of the geopolitical reality. Europe is prone to wars, and creating and accumulating capital long-term is more difficult than compared to the U.S.

By 1960, in the early days of the Eurodollar, the reserve currency status of the dollar was already disproportionately benefiting the rest of the world. The U.S. share of GDP had dropped from 50% to 40%. By 1980, only 35 years after Bretton Woods, the dollar as reserve currency had cut the United States’ share of global GDP in half, down to 25%. It has never recovered.

Source: Visual Capitalist, “The U.S. Share of the Global Economy Over Time.” The chart shows the U.S.’s share of the global economy declining and the rest of the world disproportionately benefiting from the dollar’s role. Geographic EconomicsThere are two main reasons for the relative wealth and power of the United States, and they are geographic and political, not due to the dollar. Geographically, the U.S. has natural resources in abundance, a collection of the best natural harbors in the world on the two important oceans, the largest contiguous and highest-quality farmland, more navigable rivers than the rest of the world combined and borders which are extremely cheap to defend. It would take the worst government on earth to mess that up. But instead of communism, politically, the U.S. has the strongest constitutional tradition in the world, a bill of rights and a level of state and individual autonomy that has, for the most part, restrained government overreach and abuse.

When looking impartially at the geographic and political setting of the U.S. relative to other countries of the world, it is not surprising that it is the dominant economy. It is quite destined to be so.

In contrast, there are many countries and regions of the world that remained undeveloped until the last 50 years, despite them having a much longer history of civilization and exposure to global trade than the U.S. The Eurodollar expansion made these previously uneconomic corners of the world suddenly economic to develop. New technology played a role for sure, but the game changers were artificially cheap credit, a liberal trade order in which they could securely and fairly sell their exports, and free security against their neighbors.

The global reserve status of the dollar is a critical part of the globalized order described above. Some have said that the U.S. military is the ultimate backing of the dollar, and there is some truth to that. The dollar and the military are synergistic in maintaining global peace and trade. In decades past, the alternative to picking the dollar had nothing to do with throwing off the imperialistic shackles of U.S. oppression. The alternative was existence outside the globalization umbrella, meaning much lower economic growth, more regional war and oppression by neighbors. If you withdraw the U.S. subsidy of globalization and the Eurodollar, many areas will once again become uneconomic and the cost of regional conflicts will be directly borne by the countries themselves.

Marginal Revenue Product Of DebtIn economics, there is the idea of diminishing marginal returns. Applied to credit, we often see this as the “marginal revenue product of debt,” in other words, how much growth do we get from each new dollar in debt? Early debt is highly productive, used to finance projects with the biggest bang for their buck, while later debt is relatively unproductive.

For a third-world country that hasn’t had access to cheap credit and security in its entire history, joining the globalized economy meant there was a lot of low-hanging fruit like infrastructure of roads, rail, electricity and communication that yielded great initial productivity gains. Developed economies had a similar route, but all countries are now running out of productive uses of new debt.

As countries become saturated with debt, growth slows and even reverses. Financial tools like quantitative easing, have been tried and failed to revitalize previous growth rates. You can’t save a debt-ridden system by adding more debt. The worldwide credit binge is coming to an end. The most famous example is Japan, but the pattern can be seen in the everslowing European growth rate and most recently in China. China is the last great economy to hit the growth wall.

The end of the Eurodollar system is not a voluntary process. It can no longer add productive debt and support its own weight. Not only does every dollar in new debt only create $0.25 or so of economic growth, but everyone knows it. That knowledge creates a hesitant atmosphere which depresses credit growth and endangers the ability for the economy to repay principal and interest. Even with a zero interest rate policy the system is extremely fragile.

Turning Inward And The Route To BitcoinIt is near heresy to say globalization is not a natural state of affairs. After all, it should be self-evident that free markets will tend to enhance trade and the division of labor. That’s true, but modern globalization is the result of the largest subsidy in world history, and has taken the interconnectedness of manufacturing and financial processes to absurd levels. This is becoming plainly obvious as supply chains directly failed during 2020 and problems continue into 2021. Like all subsidized activities, it is an inefficient use of capital, causing malinvestment and misallocation of resources.

Without the burden of the global reserve currency and of protecting globalization, the U.S. will be able to keep more of its wealth at home, investing time and effort into getting its own house back in order. The shift away from globalization will have profound consequences, felt most acutely in marginal economies and in war-prone regions. The U.S. is neither of these.

Signs of the end of globalization are all around us. The rise of populism, trade wars, and US withdrawal from generation-long military efforts, all speak to a breakdown in this international political order.

The Afghanistan exit is just the most glaring sign that the U.S.-led order is ending. It doesn’t matter that it was botched in every conceivable way, that just makes it all the more powerful as a nail in the coffin of globalization. Yes, the way it turned out was a blow to the U.S. reputation, but that doesn’t matter. Retreating from Afghanistan improves the U.S. financial situation, especially relative to countries bordering Afghanistan that now have to deal with a well-armed Taliban on their borders.

Returning to a position which the U.S. enjoyed prior to this grand experiment in globalization is a huge positive for the U.S. It is self-sufficient, or can be self-sufficient, and safe. If you add in the rest of North America, as an economic bloc, it could easily achieve 40% of global output and consumption, without involving itself in the messy politics of Eurasia.

As the U.S. dispenses with American-led globalization, it will also dispense with the unnecessary burden of the global reserve currency. Why would the U.S. keep a Eurodollar system plagued by a debt trap, which cedes control over the U.S. economy to international financial markets? The Eurodollar has reached its natural end and must be replaced, it is a national security issue.

As the end of the Eurodollar becomes more clear to everyone, politicians and bankers will not defend the reserve currency status all that vigorously. It is not in their best interest to do so, there’s nothing to save. The current dollar system is a massive burden, and the U.S. will voluntarily ditch for a new version of the dollar.

It’s not uncommon in U.S. history to change the dollar’s design either. On average, it has happened every couple of decades. The Coinage Act of 1834, silver coin changes in 1853, the National Banking Act 1863, the Crime of 1873, the Bland-Allison Act of 1878, the Federal Reserve Act in 1913, gold confiscation in 1933, Bretton Woods in 1944 and the Nixon Shock in 1971. It is long overdue for a revamping of the dollar once again. Perhaps most importantly, the U.S. has a history of getting rid of a central bank.

How Bitcoin Backing Will Be AccomplishedHow would a move to a bitcoin backing be accomplished? That is the million bitcoin question. I’ve given this some thought over the last couple of years, as the ultimate adoption of bitcoin becomes more and more likely. Of course, predicting the exact process is highly speculative, and bitcoin will also be used on its own or in the Lightning Network, but this is my current prediction:

It is highly unlikely, at this point, that the U.S. government will jump straight into holding bitcoin. The more natural route is through the banks, and we’ve already seen the first steps in this direction. On July 29, 2021, State Street, the second-oldest bank in the U.S., became the latest major bank to offer bitcoin-related services to clients. Others include BNY Mellon, JPMorgan, Citigroup and Goldman Sachs, which are now offering bitcoin-related services to clients.

As banks hold more bitcoin and the bitcoin price continues to rise dramatically — in part aided by the banks holding more of it — bitcoin will become a large portion of their balance sheets. This will either force the U.S. government to buy bitcoin, or simply regulate it and defer to banks holding bitcoin.

Along with the banks holding a lot of bitcoin, the U.S. would have to make bitcoin legal tender and support the formation of some sort of bank-centered Layer 2, like a federated sidechain. This sidechain might resemble Blockstream’s Liquid.

The dollar would be the denomination of perhaps 100 satoshis within that sidechain. This would give banks the ability to extend credit to a minimum degree according to the federation policies while enabling maximum transparency, thereby addressing the common criticism against the fixed supply of bitcoin. (Not solving for the fixed supply, that doesn’t need solving. But enabling some form of elasticity.)

This process would entail a drastic weakening of the Federal Reserve, and a return to a somewhat forgotten era in the U.S. where banks, not central banks, were ascendant. As the U.S. rediscovers its populist and non-interventionist past, it will also redefine its monetary system in line with the past as well, this time around bitcoin.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.